Tag Archives Business/Finance

The case for making cash flow projections

Financial Planning: A cash flow projection is a versatile financial risk management tool

My answer to “the question”

What Brian Wittal has been telling farmers the markets will do this year

Finding value in the stock market

Guarding Wealth: With soaring pot and cryptocurrency stocks, it can be hard to find value in the market

Using annuities for an income stream

Guarding Wealth: They’re rock solid investments and eliminate market risk, but annuities are not cheap

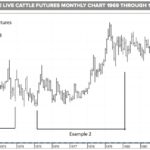

More on feeder cattle risk management

Market Update: Looking a little deeper into messages from the market

Grain marketing lessons learned the hard way

Events in 2017 gave us many opportunities to make grain marketing mistakes

Is private crop insurance a fit for your farm?

Two Sask.-based companies are in the market. Find out how their products work

U.S. tax cuts will increase beef demand

Market Influences: Consumers will have more disposable income, leading to more spending

Finding the price in the new age

With delisted futures contracts, who’s responsible for price discovery?

New digital data platform on the Prairies

The Climate Corp. launches its Climate FieldView service in Western Canada