Tag Archives Business/Finance

Evaluating your investment performance

Are you getting your money’s worth when it comes to mutual fund fee structures?

The folly of market predictions

For the best long-term predictions, predict that most predictions will be wrong

Farm Financial Planner: Transferring farmland, minimizing taxes

With good advice, land can be transferred to the next generation with minimal taxes

Thoughts on investing in real estate

Most farmers have invested in a home and in farmland. These investments are not risk free

Making your farm plans for the year

Price expectations and your risk management strategy impact your marketing plan

The much-maligned RRSP

RRSP’s have a bad reputation lately, but for many investors, they’re a good option

Your farm financial scorecard

Farm financial statements can offer you a lot more than just a way to keep score

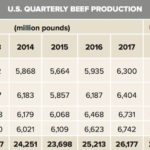

Canadian prices divorce from U.S. fundamentals

Market Update with Jerry Klassen: Alberta feeding margins are in the red by $200 per head for feedlots selling in the spot market

Investment success factors

Some personal and investment-focused factors that drive investing success

Building a crop risk management strategy

A crop risk management strategy is your plan to protect your farm from unexpected loss