During the first week of September, Alberta packers were buying fed cattle on a live basis at an average price of $307 per hundredweight FOB feedlot in southern Alberta for pickup within two weeks. This is up about $10 per cwt from two weeks earlier.

Alberta packers were showing bids on a live basis at $325 per cwt. FOB feedlot in southern Alberta for April 2026 delivery. Strength in the deferred live cattle market has resulted in stronger values for replacements.

In early September, mixed steers averaging 1,000 pounds coming off pasture were valued at $445 per cwt. FOB ranch in central Alberta. This is up a solid $15 per cwt. from the third week of August.

Read Also

India likely to triple lentil import duty

Analysts anticipate India hiking duties to 30 per cent after March 31 to bolster domestic prices on expectation of strong harvest.

At the Gladstone Auction in Manitoba, red and black exotic steer calves averaging 516 lb. traded for $717 per cwt. During the first week of September, lighter-weight calves were up $20 per cwt. from 14 days earlier.

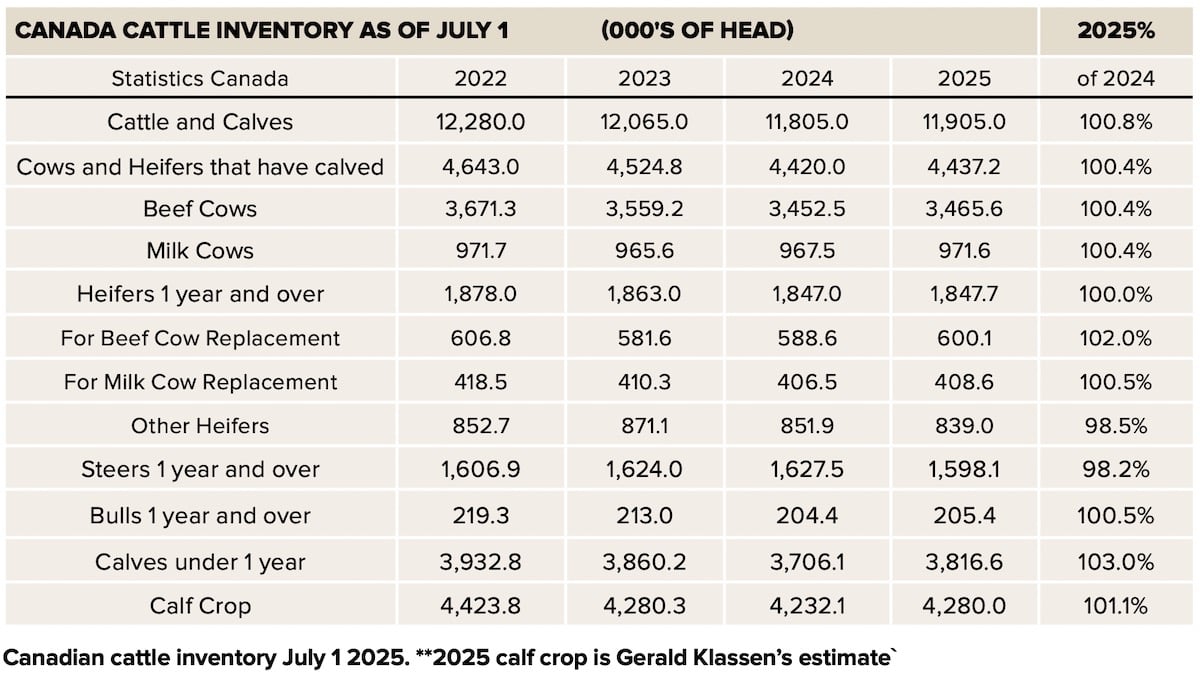

The cattle market is functioning to encourage expansion and ration demand. Statistics Canada’s July 1 Semi-Annual Cattle Inventory Report confirmed expansionary behaviour. We’ve included the data from this report.

The number of beef cows that had calved as of July 1, 2025, was up 13,100 head from a year ago, while milk cows were up 4,100 head from last year. We’re seeing more Holstein-cross feeders move into feedlots every year. More importantly, replacement beef heifers as of July 1, 2025, were up 11,500 head from a year earlier. Once heifer retention begins, it’s usually followed on a larger scale for the next two or three years.

Over the next 12 months, we expect to see 40,000 to 50,000 head of heifers held back for herd expansion. We’re estimating the 2025 calf crop at 4.280 million head, up about 48,000 head from the 2024 output.

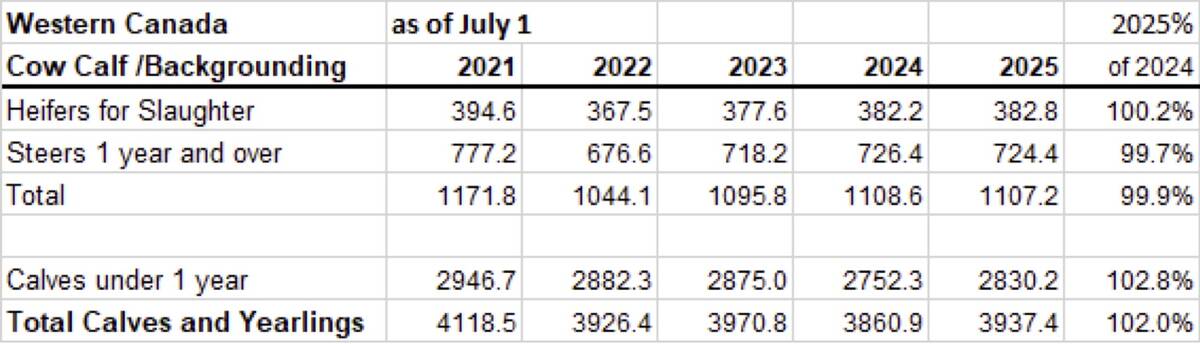

Statistics Canada does a good job of breaking down the data by province by farm type. Calves under one-year old on cow-calf and backgrounding operations in Western Canada as of July 1 were 2.830 million head, up 77,900 head from last year. Heifers and steer yearlings outside finishing feedlots in Western Canada as of July 1 in were 1.107 million head, down only 1,400 head. This won’t have much of an influence on the market, but it shows that feeder cattle supplies outside finishing feedlots were above year-ago levels in Western Canada on July 1.

The second function of the feeder market is to ration demand. The market has to trade high enough so that feedlot operators back away from the market. For November through December, the pen close-out fed cattle break-even price is in the range of $290-300 per cwt. on a live basis. If the fed cattle market stays at current levels, feedlots will be profitable throughout the fall. However, for March and April, the fed cattle break-even price increases to the range of $320-330 per cwt. This tells us that the feeder market has likely run its course for the time being.

The Alberta fed cattle market for April was at $325 per cwt. at the time of writing this article. If the feeder market continues to strengthen, feedlot margins will move into negative territory in the deferred positions.

The most profitable period for the cow-calf producer is when the U.S. economy moves into the expansion phase of the business cycle. The business cycle has four phases, which include contraction, trough, expansion and peak. We can now say that the U.S. economic cycle is in the peak phase, which will be followed by a contraction. Those of you who have been reading this column the last five or six years know that I was advising cow-calf producers to expand their herds during the 2020 recession through 2022. Interest rates were at historical lows, and heifer prices were low. Producers needed to expand at the lows to have calves to sell at historical highs.

Very simply, this has been a demand-driven rally as disposable income increased for the average American. U.S. restaurant traffic has been running 10 per cent above year-ago levels. When restaurant traffic drops to one per cent over year-ago levels, the peak phase of the expansion of the business cycle is over, and this feeder market will start trending lower. This indicator is as good as any.