During the last week of July, Alberta packers were buying fed cattle on a dressed basis in the range of $503-505 per hundredweight delivered, which was a fresh historical high.

Live bids in southern Alberta were quoted from $297 to $300/cwt.

Break-even pen closeouts for major feedlot operators are in the range of $275-$286/cwt. Margins have been in positive territory since the spring, and this has been a major factor supporting the feeder market.

Read Also

Fall clean-up and bringing animals home at the Eppich ranch

Winter is approaching which meant emoving old fence rows and bringing livestock home before the cold and the snow at the Eppich family ranch.

Yearling steers off grass averaging 1,000 pounds have been trading for $405-410/cwt. in southern Alberta, while 500-lb. steers have been selling in the range of $660-$670/cwt. across the Prairies.

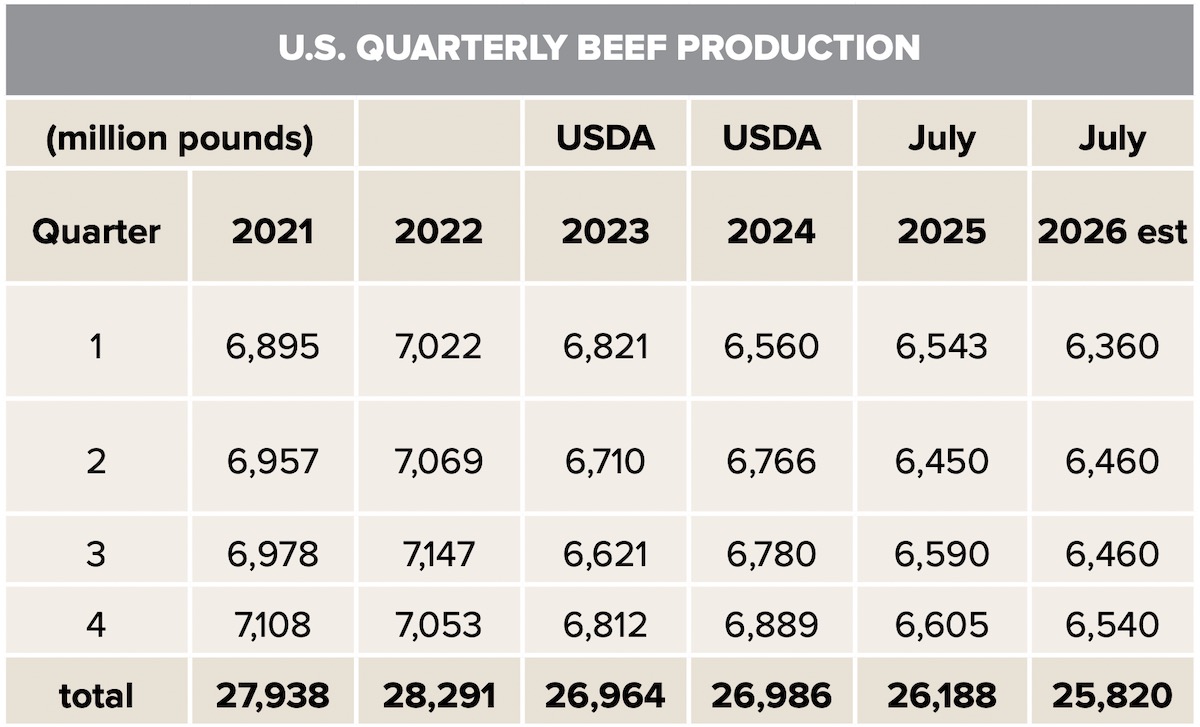

The U.S. cattle herd remains in a contraction phase. Lower feeder cattle supplies will result in a year-over-year decline in feedlot placements, which will cause lower beef production during 2026.

It appears Canadian barley and U.S. corn crops will come in larger than earlier anticipated. This has also contributed to stronger feeder cattle prices. Wholesale beef prices are down from the June highs, but beef demand shows no sign of easing.

U.S. cattle on feed inventories as of July 1 totalled 11.124 million head, down two per cent or 180,000 head from July 1, 2024. While inventories are below year-ago levels, it’s important to realize that U.S. cattle on feed 180 days or more as of July 1 were actually up 34 per cent from 12 months earlier. U.S. dressed weights are running 20 lb. above last year and 40 lb. above 2023. There is no shortage of fed cattle in the short term.

The U.S. weekly slaughter continues to trail last year. This will keep U.S. market-ready fed cattle supplies above year-ago levels throughout the summer and early fall.

In Western Canada, Alberta and Saskatchewan on-feed inventories on July 1 were 862,080 head, down one per cent or 9,026 head from July 1, 2024. Feedlots in the two Prairie provinces are more current than their U.S. counterparts. Cattle on feed 180 days or more were marginally lower than last year, while dressed weights were running similar to year-ago levels.

In Canada, the June slaughter was above June 2024, while in the U.S., the June slaughter was down from 12 months earlier.

Wholesale choice beef was trading at US$361/cwt. in early August, down from the June peak of US$392/cwt. Packing margins remain in positive territory despite the softer wholesale market. Larger carcass weights have partially offset the lower slaughter pace.

In Canada, restaurant traffic during the first week of August was running 30 to 35 per cent above year-ago levels. In the U.S., restaurants were taking in 10 to 15 per cent more customers than last year. U.S. consumer spending at restaurants has been running six to seven per cent above last year.

Grocery store sales have been running 1.5 per cent above year-ago levels. Data from Statistics Canada shows that Canadian spending behaviour has mirrored that of consumers south of the border.

The U.S. cattle herd remains in a contraction phase. The U.S. Department of Agriculture’s semi-annual cattle inventory report estimated the 2025 calf crop at 33.1 million head, down 429,000 head from the 2024 calf output. Heifers for beef cow replacement on July 1 were down 100,000 head from 12 months earlier; the number of beef cows with calves on July 1 was down 350,000 head from the year-ago level.

U.S. feeder cattle outside finishing feedlots as of July 1 came in at 34 million head. This compares to the July 1, 2023 number of 34.7 million head. (There was no survey in 2024 due to budget cuts.)

This is a modern-day historical low. The U.S. border remains closed to Mexican feeder cattle due to New World screwworm, and there is no signal that this will change anytime soon.

In Western Canada, we’re expecting Statistics Canada data to show a three to four per cent year-over-year decline in feeder cattle supplies outside finishing feedlots. The Canadian semi-annual report comes out in late August, and all eyes will be on this data.

In Western Canada, cow-calf pairs have been trading in the range of $6,500-$7,000 throughout June and July. This price reflects recent cull cow values, which have surged to the range of $3,200-$3,400. Currently, a 500-lb. steer is bringing back around $3,300.

Past history tells us that cow-calf producers make the decision to hold back heifers for herd expansion in the fall. This may tighten the feeder cattle supply beyond normal fundamentals. If there is significant heifer retention, this may cause the feeder market to overextend to the upside.

Feedlot operators usually have to experience one full round of negative margins before there is a serious downward adjustment to the feeder market. Therefore, cow-calf producers can expect the calf market to remain strong throughout the fall and winter.