During the third week of August, Alberta packers were buying fed cattle on a dressed basis at an average price of $500 per hundredweight delivered, relatively unchanged from a month earlier. Using a 60 per cent grading, this equates to a live price of $300 per cwt.

Ontario packers were buying Grade A steers on a dressed basis at $527 per cwt., which equates to a live price of $316 per cwt. There appears to be stronger packer demand in the short term.

Wholesale beef prices made fresh historical highs in mid-August, with Choice product reaching US$405 per cwt., up US$15 per cwt. from a month earlier.

Read Also

Get ready for an eventual transition on cattle traceability

When new federal cattle traceability rules do ultimately take effect, reporting requirements will vary for producers, transporters, feedlots and markets — but most of the onus will be on producers.

In central Alberta, 1,000-pound steers traded for $431 per cwt., f.o.b. ranch. In Ponoka, grass and mineral-fed Charolais-cross steers weighing 650 lb. moved through the ring at $604 per cwt. Compared to the last week of July, Canadian feeder cattle prices are up $20-30 per cwt.

As of August 1In Alberta and Saskatchewan, cattle on feed in 1,000-head plus feedlots as of Aug. 1 were 777,443 head, relatively unchanged from last year. However, cattle on feed 180 days or more totalled 203,285 head, up 16 per cent or 27,682 head from 12 months earlier. Market-ready fed cattle supplies are up from last year, but this hasn’t resulted in a weaker fed cattle market. Western Canadian marketing weights are similar to last year.

In the U.S., cattle on feed 150 days or more and 180 days or more are also above year-ago levels. Dressed weights are up about 15 lb. from last year and up 45 lb. from 2023. There is a backlog of market-ready fed cattle supplies in the U.S.

Feedlots appear to be content to hold cattle to heavier weights and hold out for higher prices given the fact the market has been trending upward. At some point, the market will turn and start to decrease, which could spur on selling of fed cattle from major feedlot operators.

U.S. packers have purposely curtailed the weekly slaughter pace in an effort to hold up the wholesale beef market. This has contributed to the build-up of market-ready fed cattle in the U.S.

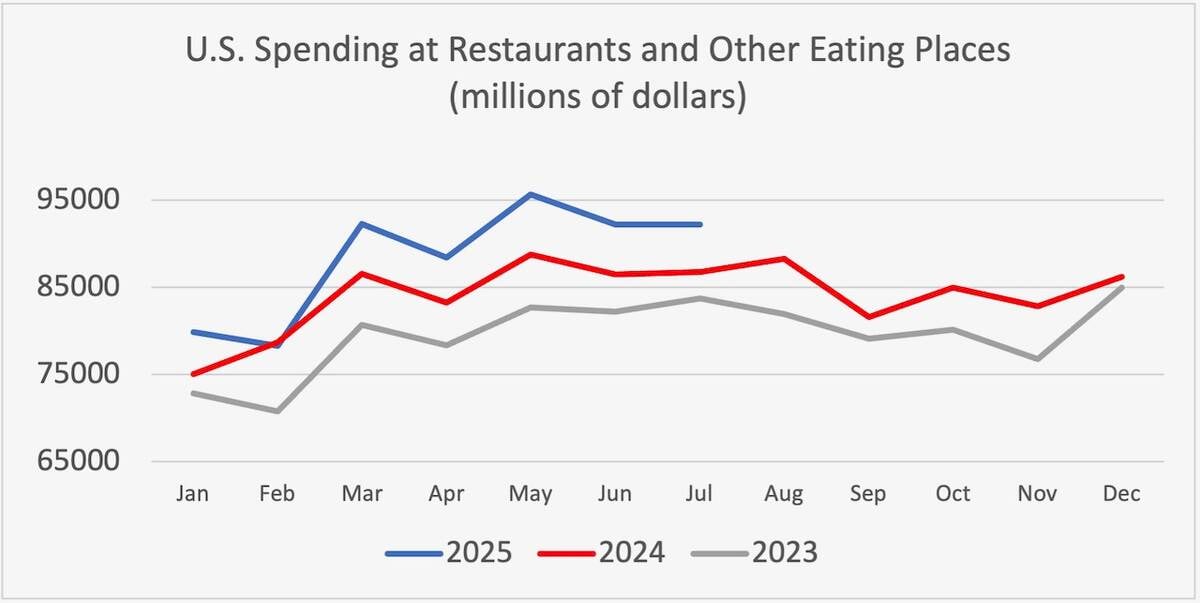

Beef demand tends to remain firm until after the Labour Day weekend. During September and October, beef demand tends to make seasonal lows. Restaurant and grocery store spending tends to decrease in September as students go back to school and business travel subsides.

The function of the feeder cattle market is to encourage production and ration demand.

The U.S. beef cow slaughter is on pace to drop to 2.6 million head, down about 550,000 head from 2024. When the beef cow slaughter is this low, it’s usually the first sign of expansion activity. However, we haven’t seen significant heifer retention on either side of the border, which is the second signal for expansion behaviour. The U.S. Department of Agriculture is forecasting a minor year-over-year decrease in the U.S. calf crop for 2025, and we’ll likely see a similar trend in Canada.

In regard to rationing demand, please consider the following example. We mentioned that 1,000-lb. steers were trading for $431, which equates to a value of $4,310. A finished animal with a live weight of 1,500 lb. and a dressed weight of 900 lb. is valued at $4,500. Feedlots cannot add 500 lb. to an animal for 40 cents per pound. The cost per pound gain for barley and silage only is around 90 cents per pound. Feedlots buying these yearlings at the current levels are banking on significant upside in the fed cattle market.

History tells us that feedlot operators usually need to endure one full round of negative margins before there is a sizable downward adjustment in the feeder market. Feedlot operators basically need to turn their feedlot one time and have negative margins on all the cattle before they lower the bids for replacements. The feeder cattle market will be in the process of rationing demand through the winter and spring of 2026. Cow-calf producers can expect the feeder market to hold value through fall period.

The cattle markets are extremely sensitive to demand at historical highs. U.S. beef demand on a per capita basis is actually higher than last year. U.S. restaurant traffic has been running eight to 12 per cent above year-ago levels. Total spending at restaurants is up six per cent year-over-year. In Canada, restaurant traffic has been up 25-30 per cent year-over-year.

Notice that restaurant spending makes a seasonal low in September. This may result in softer wholesale prices and weaker fed cattle values. If the U.S. economy starts to weaken due to the Trump tariffs, beef demand will decrease as disposable income declines. This is the “black swan” variable that could cause the cattle and beef markets to weaken.