I am keenly interested in cow depreciation and in fact have written about it in past Grainews columns. It is one of the largest direct expenses on a cow-calf operation — usually only behind feed — and it is worth touching on again in the wake of current record-high prices.

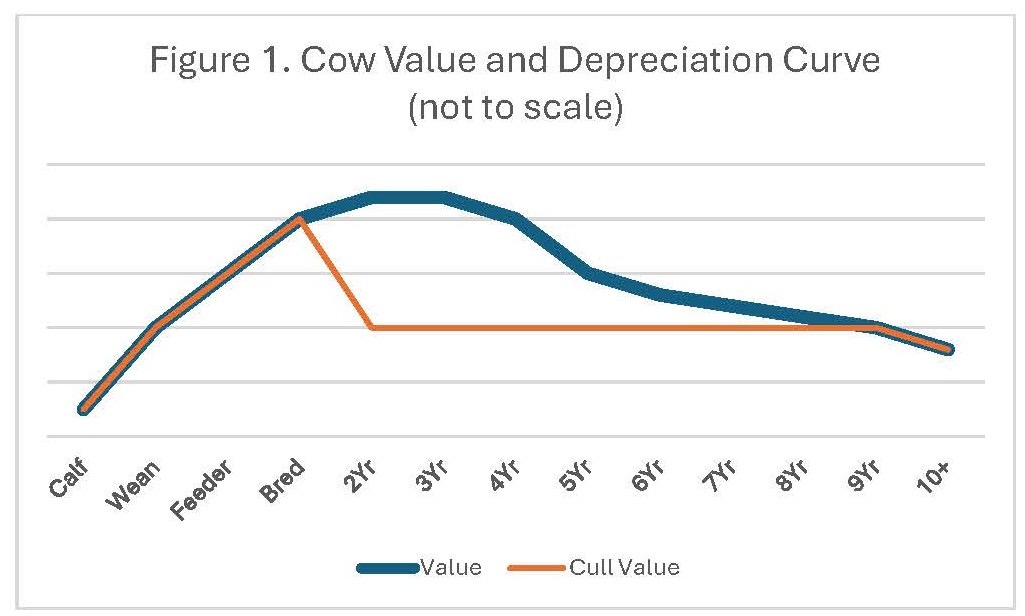

First as a reminder, Figure 1 here shows the general shape of the cow depreciation curve from birth, and the depreciated value of an animal that does not make the cut.

Early in life a heifer is worth what she sells for as a weaned calf or a feeder. In this example, we are assuming a bred heifer has more value than an open feeder heifer.

Read Also

Fall clean-up and bringing animals home at the Eppich ranch

Winter is approaching which meant emoving old fence rows and bringing livestock home before the cold and the snow at the Eppich family ranch.

When that heifer calves, she is hopefully worth at least as much as when she was a bred heifer, and she probably retains that value for at least a couple of years until she starts to age out of the cow herd or comes up open.

The depreciation on an individual cow is represented by the space between the orange and blue lines. In traditional thought, the earlier a cow falls out of the herd, the greater that loss, as we have not had time to recover our establishment expenses on that cow (growing, weaning, breeding, getting into production).

Open cows are a problem, particularly two-year-olds as is visible by the huge gap between the blue value line and the orange cull line on two-year-olds (coming three).

This is not a lot different than what has been written before. However, it assumes one thing: that prices are relatively constant — and they have been anything but the last couple of years. If we look at Canfax values over the last few years, we can see some meteoric change in prices, but in the background, there are also some meteoric changes to cow depreciation.

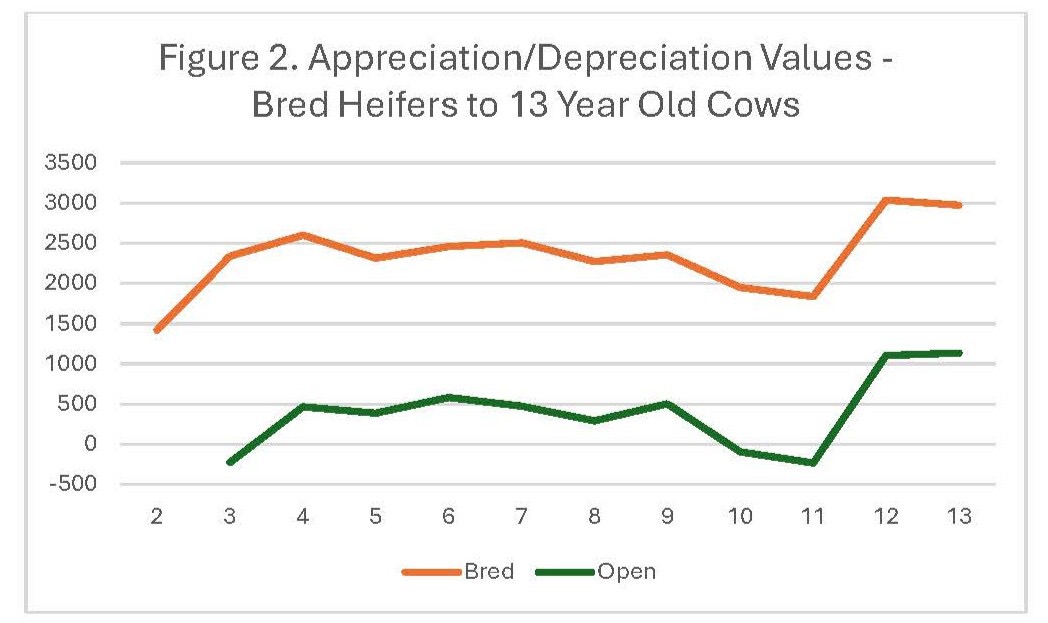

For this example (Figure 2 here), I used the average of November/December prices from 2012 to 2024 (note that 2024 only includes November pricing) from Canfax for western Canadian bred heifers, bred cows and Alberta D1/2 cows. I assumed that heifers were 1,200 lbs. as two- to three-year-olds, and cows were 1,500 lbs. I assumed cows entered the herd valued as average-priced bred heifers. When we graph the depreciation out on these cows, we get a very different picture than is shown in the depreciation curve in Figure 1.

Depreciation is usually negative; however, if we look at today’s pricing, it’s evident there are very real value increase in many of these cows. As of the time of writing, most classes of cattle have appreciated in value, with older cows being among the highest for appreciation. This is largely because they were brought into the herd at a very low cost, in the middle of a low point in the cattle cycle.

There are a couple of important parts to this graph that are worth noting. First, the difference between the top line and the bottom line reflects that cost and importance of getting cows bred. Open cows have a tremendous value loss. The second thing to focus on is the Open line on three-year-olds and 10- to 11-year-olds.

Even with historically high prices, both of these groups still show depreciation, and it is around $225 of loss for each category of cow. If we look deeper into what is going on here, these cows entered the herd near the top of the cattle cycle. The potential for depreciation is higher when the initial purchase cost is higher.

Finally, it is important to remember that these are values based on cattle in a herd today. It is very unlikely you have all of the heifers from 10 years ago still in your cow herd, and you have already taken depreciation on a lot of the cattle that have come through your operation in the last decade or more, at much greater expense than today.

It is also important to remember that depreciation is offset by production. A cow that is nearly fully depreciated today is likely producing the highest-valued calf of her lifetime, given current markets. How the market impacts depreciation — and potentially your strategies to manage forward — is worth considering in both good times and bad.

Every cow herd has different strategies and different pricing structures, so this example only applies in a broad sense across the spectrum of industry, but awareness of depreciation can be a key driver of ranch profitability.