Tag Archives Market Update

Calf market will feel the pinch come fall

Market Update: It will take time to work burdensome beef supplies through the U.S. system

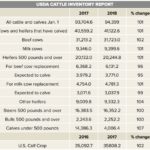

Tighter feeder cattle availability ahead

Market Update: Drought in southern Plains has moved more cattle to feedlots

Market message: Time to cut beef production

Market Update with Jerry Klassen: The market will bounce back temporarily, but producers should consider liquidating cows

U.S. tax cuts will increase beef demand

Market Influences: Consumers will have more disposable income, leading to more spending

Strong demand enhances cattle prices

Market Update: Consumer spending in the U.S. is a major price driver

Lower supply outlook strengthens cattle prices

Market Update: The market is not getting more bearish but rather looking neutral to bullish

Producers urged to sell earlier this fall

Market Update: Market expected to go lower heading into the fourth quarter of 2017

Cattle market endures volatility

Market Update: Beef oversupply will be an issue unless consumer spending picks up

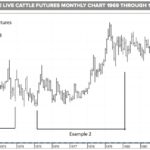

What is the cattle futures market saying?

The combination of cash and futures market numbers will point the way

Understanding feeder cattle options

The Markets: Using a “put” option to avoid margin calls