I receive many calls from cow-calf producers regarding the timing of feeder cattle sales.

Ranchers often feel they are at the mercy of the market. Cow-calf producers often feel they have no control on their marketing schedule. Many producers sell at the same time every year because that was the marketing strategy for their parents and grandparents. Many cow-calf producers call me a week before they plan to sell and ask which way the market is trending.

I receive all types of questions and every question is valuable. Marketing calves can be extremely stressful. From a psychological standpoint, if producers have options, they feel more comfortable because no one likes to have their hand forced. Secondly, according to “cloud theory,” the most flexible is the most stable. Producers with flexibility are often less stressed about their marketing decisions.

Read Also

India likely to triple lentil import duty

Analysts anticipate India hiking duties to 30 per cent after March 31 to bolster domestic prices on expectation of strong harvest.

So it’s a good time to discuss three fundamental factors to consider when marketing your calves over the next four to six months. Backgrounding operators can also glean insight from this information to help with their overall marketing strategy.

The market signals

Feeder cattle futures reflect a large carrying charge between January and August 2023. As of mid-January, the January feeder cattle futures were hovering at $184 while the August 2023 contract was trading above $201.

Very simply, the longer you hold your feeder cattle, the more valuable they become. This is rule number one when the futures market reflects a large carrying charge. If the August future is trading at a discount to the January contract, feeder cattle would be worth less the longer you hold onto them.

The second factor to consider is the spread between the live cattle futures. When the calves will be ready for processing has a major influence on the feeder cattle price structure. Also as of mid-January, the February 2023 live cattle futures were trading at $156 and the April 2023 contract was just above $160. The June contract was also near $156 but the December 2023 contract was at $163. Feeder cattle that will be finished for the summer market will be worth less than cattle that will be available for the final quarter of 2023.

What are some options?

This leads into flexibility options. A calf weighing 500 pounds sold in December 2022 is light enough to be available for the grasser market in spring of 2023, or it can be sold into finishing feedlot in the spring. During December 2022, calves weighing 500 pounds were trading for $295-$300/cwt but 650-pound calves were selling around $255. The sharp discount incorporates the limited options for these 650-pounders. It’s most likely these 650-pound feeders will be put on feed for finishing and they don’t have the grass option. Thus they will come on the fed market in summer instead of capturing the December 2023 premium in the live cattle futures.

U.S. feeder cattle supplies outside finishing feedlots as of Oct. 1, 2022 were down 1.0 million head from Oct. 1, 2021. The November Cattle on Feed Report had October placements down 138,000 head from October of 2021. This year-over-year decline in placements is expected to continue throughout the winter.

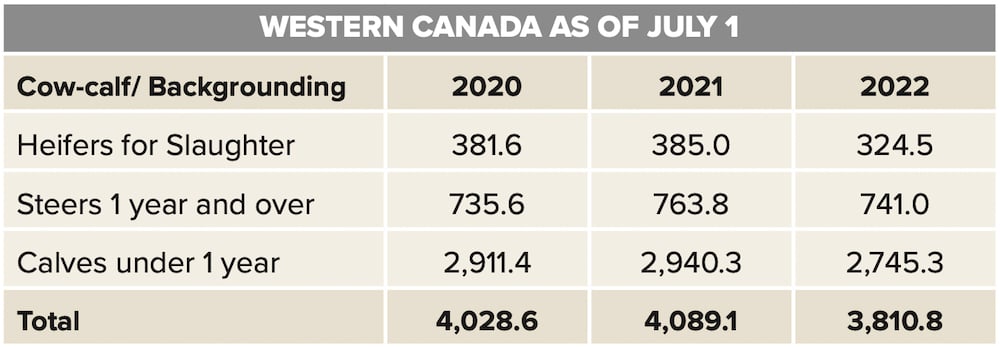

In Western Canada, we have to look back to the July 1 data from Statistics Canada (see below). As of July 1, Western Canada supplies of yearlings and calves outside finishing feedlots (on cow-calf and backgrounding operations) were down 278,300 from July 1, 2021 and down 217,800 head from July 1 of 2020.

According to Canfax, feedlot placements into finishing feedlots from July 1 through October were 781,900 head. This is down approximately 55,000 head from last year. This doesn’t account for feeder imports but it appears that feeder cattle supplies outside finishing feedlots in Western Canada on Nov. 1 were down 225,000 head from Nov. 1 of 2021.

Positive feedlot margins

Lower feedlot placements will result in lower cattle-on-feed inventories and a year-over-year decline in beef production. Alberta fed cattle basis levels have been quite strong for the second quarter of 2023. Feedlot margins are expected to move into positive territory during the spring. If possible, cow-calf producers should try to market their calves when finishing feedlot margins are in profitable territory.

Another rule of the thumb is don’t market your calves during the first snowfall or first bout of adverse winter weather in the fall. Producers should plan to sell in September when it’s dry, or in late November or December. The feeder market tends to incorporate a risk discount during the first couple or months of winter weather and this can weigh heavily on the basis.

Having marketing options helps alleviate stress when selling feeder cattle. It’s important that cow-calf producers realize the spreads in the feeder and live cattle futures. This fall, we had a year-over-year decline in feeder cattle supplies outside finishing feedlots on both sides of the border. Cow-calf producers should try to market calves when the finishing operators see positive margins. Futures traders always say that futures trading is 95 per cent mental and market analysis and five per cent action. Selling feeder cattle is similar. Even though cow-calf producers sell once or twice per year, they cannot ignore the market for 11 months of the year and expect to be successful long term. As my dad always said, push that pencil after supper. That is where and when you will make your money.