During the last week of August, Alberta packers were buying fed cattle on a live basis in the range of $180-$181/cwt delivered, up $7-$8/cwt from 30 days earlier.

U.S. and Canadian beef production has been running above a year ago, and beef demand has exceeded earlier projections. Inflation pressures on both sides of the border appear to be easing, which has enhanced consumer sentiment. Wholesale prices have slightly improved. At-home and away-from-home food spending is running sharply above year-ago levels.

Western Canadian yearling prices have strengthened by $8-$10/cwt over the past month. At an auction market south of Edmonton, larger-frame Simmental-blended steers fresh off grass with full health data averaging 915 pounds sold for $234/cwt. In southern Alberta, Charolais-based steers weighing 800 pounds dropped the gavel at an astonishing $255/cwt.

Read Also

Get ready for an eventual transition on cattle traceability

When new federal cattle traceability rules do ultimately take effect, reporting requirements will vary for producers, transporters, feedlots and markets — but most of the onus will be on producers.

Statistics Canada confirmed the year-over-year decrease in feeder cattle numbers in Western Canada on the July 1 Cattle Inventory report. This report comes on the heels of USDA data, which also showed a sharp year-over-year decrease in calf inventories. There is a bullish fundamental case brewing in the cattle market for the next six-to-eight-month period.

Statistics Canada released their July 1 Cattle Inventory Report August 23. They provide a breakdown of the cattle by class and farm type, which is very useful information. Calves under one year old on Western Canada cow-calf operations as of July 1 came in at 2.291 million head, down 144,000 head from 2.435 million head a year ago. On stocker or backgrounding operations, calves under one year came in at 0.505 million head, down 51,000 from last year. Total calves outside finishing feedlots as of July 1 were down 195,000 head from year-ago levels.

The number of yearlings was also down from year-ago levels. On cow-calf and backgrounding operations, the number of heifers one year old and over for slaughter as of July 1 was 0.325 million head, down 60,000 head from last year. The number of steers one year old and over was down 83,000 head form last year.

Decline in feeder cattle

If we add up yearlings (heifers and steers) and calves under one-year-old, the number of feeder cattle outside finishing feedlots in Western Canada as of July 1 was 3.811 million head, down 278,000 head from last year. This is fairly significant.

The USDA released their July 1 Feeder Cattle Supply and Disposition report July 27. The number of U.S. feeder cattle outside finishing feedlots as of July 1, 2022 came in at 35.7 million head, down one million head from July 1, 2021.

There is a sharp decrease in available feeder cattle supplies on both sides of the border heading into the fall period.

Over the winter, the cash feeder market will function to encourage production. This will cause the cow slaughter to decrease and heifer retention to increase. During the late fall, I experct a 400,000 head year-over-year increase in heifer retention, which will further drain the feeder cattle pool. Next spring, the feeder cattle market will function to ration demand. Prices need to overextend to upside so that feedlot buying interest backs away from the market. During April and May of 2022, I expect the feeder market to be extremely strong.

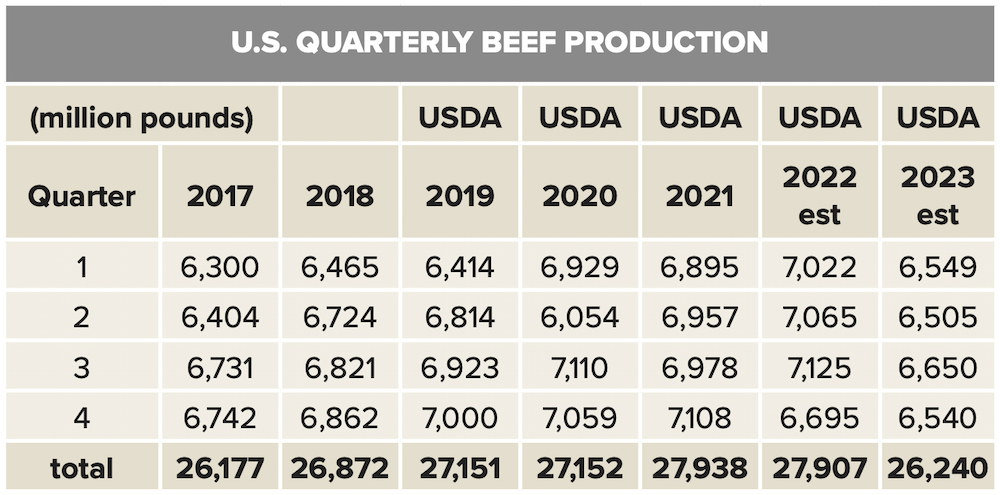

The USDA made minor revisions to their quarterly beef production estimates on the last World Agriculture Supply and Demand Estimates (WASDE). Feeder cattle placements into feedlots will be down from year-ago levels. U.S. 2022 fourth-quarter production is expected to be down 413 million pounds compared to the fourth quarter of 2021. We’re looking for a supply shock in the beef market during the first half of 2023. U.S. first- and second-quarter beef production is expected to be down approximately 500 million pounds from the same quarters of 2022.

The U.S. and Canadian economies are on solid footing. U.S. gas prices are down 20 per cent from the June highs. Supply chain backlogs were responsible for about 40 per cent of inflationary pressures. China’s exports during July were up 18 per cent from a year earlier and recorded the fastest pace so far in 2022. Container rates are slowly coming down and the computer chip shortage is over. Makers Micron and Nvidia have both reported softer demand.

Inflation is easing which was the largest concern for consumers this summer. We now find the University of Michigan’s Consumer Sentiment improving. The U.S. and Canadian economies have divorced from the global problems, which include Russia’s War with Ukraine and the struggling Chinese real estate market.

I have a fairly optimistic outlook for beef demand. Food spending made a seasonal high in July. We may see seasonal demand as students go back to school but this will be short-lived. Beef demand makes another seasonal high in November and then again in March. Supplies are rather tight so the slippage due to softer demand will be minimal. Beef demand is rather inelastic.