Young farm families have many expectations to manage as they work on farms as employees, raise small children and juggle time to generate off-farm revenue.

Asking for higher compensation can be difficult, and arguments arise when what you think you need is perceived by your employer, the farm parents, as a want.

Talking about money doesn’t have to be stressful when you come prepared with data or a “reality check” of what you need. Be clear about what you see as fair compensation.

Read Also

Is the technology in our vehicles a help or a hindrance?

Not only does new tech allow people to operate vehicles and farm machinery with fewer skills, it also creates more problems for vehicle users when those systems fail, Scott Garvey writes.

One of the best ways to reduce stress about compensation from the farm is to figure out what you need to cover all personal living expenses for your family.

READ MORE: Froese: Too much farm drama?

I can imagine people groaning as they read this, but here are some useful strategies to help young farm families figure this out. These tips also apply to founders who need a clear understanding of their income stream needs as they step back without stepping away on the farm.

I recently spoke to a group of dairy farmers and suggested a family of four needs about $84,000 per year to cover living expenses. On our farm, Wes and I typically spend $75,000 annually. This doesn’t include charitable contributions or investments, and we don’t have a house mortgage.

Everyone’s number for annual living expenses is their number, but you need data to determine required cash flow and expectations for family living. Here’s how to get started.

Get data. Review the previous year’s bank and credit card statements to see what you spent for family living. Track what you are now spending, using receipts and bank records. Find an easy way to keep track of financial information so you get good data. Find out what other young farmers make for income in comparable scenarios.

Try using the AGvisorPro app to connect with farmers and consultants who are willing to share information. Try other resources, like Farm Credit Canada’s cost of living calculator. Iowa State University Extension also has a useful guide, “Benchmarking Family Living Expenses in Agriculture,” which you can find within its website.

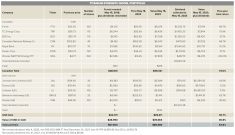

Use Dick Wittman’s compensation worksheet. As I wrote in my April 18 column, Dick Wittman has a tool called the Performance Evaluation Worksheet that can help you nail down wages or salary. It can also help calculate farm perks, such as housing, utilities, cell phone, internet, pickup truck, fuel, meals, garden produce, etc. Many families forget all the items the farm is paying for. Expenses like these can add up to $14,000 or more.

READ MORE: Help! My parents have loads of debt we don’t want!

Consider your goals to achieve equity in the farm business. What debt are you willing to take on to gain ownership of land, equipment or livestock? If the farm wages/salary you’re getting is just enough to live on, you are likely not getting enough compensation to have disposable income for farm debt payments. Before computer spreadsheets, we kept track of debt payments in a yellow scribbler and we would celebrate paying off farm loans. What are your timelines for moving from being an employee of the farm to a partial owner?

Talk about money with your spouse. When you and your spouse have the same goal of gaining growth opportunities in the farm business, you are both pulling in the same direction. If you fight about what the family needs versus what the farm needs, you need to seek deeper understanding of what can wait and what needs to happen now to meet the family’s needs. What investments today will make money? Which debt is good debt? Does everyone understand the concepts of “save” or “wait?”

Discuss what “sacrifice” means to your family and to the larger farm team. Author Lance Woodbury talks about sacrifice as a gift, necessity or crutch in The Double Edge Sword of Sacrifice. Compensation may be kept low for young farmers as a crutch when the real issue is lack of business financial performance or too many family members working in business.

In other cases, Woodbury says, “sacrifice is used as a way for parents to avoid hard choices about succession planning and the process of letting go.”

I recall hearing founders say they want the next generation to suffer as they did. Yikes! Where is it written that young farm families need to suffer economic hardship to appreciate the opportunity to farm?

Arrange a farm team meeting to discuss current compensation and what needs to change. Be clear about what level of wages or salary you need for your family’s well-being. If you need a human resources specialist to help with employee contracts, reach out to Lindsay Seafoot at [email protected]. She works with ag families from Wawanesa, Man.

Celebrate how you manage your income well. Let your spouse and your farm team know you are grateful for what you can accomplish together with the resources provided.

Talk with your spouse if you have concerns about overspending. Discuss what money means to you. Examine what you truly need for both of you to accomplish financial goals. Listen to the “Moolala: Money Made Simple with Bruce Sellery” podcast. Sellery authored Moolala: Why Smart People Do Dumb Things with Their Money.

Work to have compensation matched to the roles and skills you provide on the farm. Just because two siblings work as employees on the farm, it does not mean their different skills — for example, farm labour versus farm manager — deserve the same income. I’ve seen disputes arise over this when the farm owner is conflict averse and not fair with compensation for different skill sets. This kind of situation may need mediation and facilitation with a coach.

Reach out to Elaine and I will send you a folder with Wittman’s compensation tool along with pdfs of Woodbury’s The Double Edge Sword of Sacrifice and Iowa State’s “Benchmarking Family Living Expenses in Agriculture.”

Every farm family, old and young, needs enough financial resources to live well and grow the business. Talking about money and understanding the money scripts in your family will create more harmony. Being clear is kind.