In your June 10 issue of Grainews, I wrote about pivoting investments toward world markets, outside of Canada and the U.S., as I am concerned with the state of affairs in our two countries. I would like to expand on those thoughts in this issue.

Firstly, however, as I write we have just crossed the halfway mark of 2025, and a quick recap of our two markets is in order. The U.S. S&P 500 cratered 21 per cent between Feb. 19 and April 7. It then staged a remarkable rebound, recovering all its losses and reaching a new all-time high. While a 21 per cent decline meets the classic definition of a bear market, this behaved more like a major correction, with a quick drop followed by a quick recovery. Bear markets tend to start slowly and build over time. Canada’s TSX, which generally exhibits more stability than the S&P 500, was down a modest 13 per cent before fully recovering.

From a year-to-date perspective, the TSX was up 8.6 per cent at the halfway point, with the S&P 500 up 5.5 per cent — remarkable performances, given the levels of uncertainty in trade and geopolitics. That said, I remain concerned from valuation, political and economic standpoints, bringing me back to the main focus of this article: other countries in the world.

Read Also

Is the technology in our vehicles a help or a hindrance?

Not only does new tech allow people to operate vehicles and farm machinery with fewer skills, it also creates more problems for vehicle users when those systems fail, Scott Garvey writes.

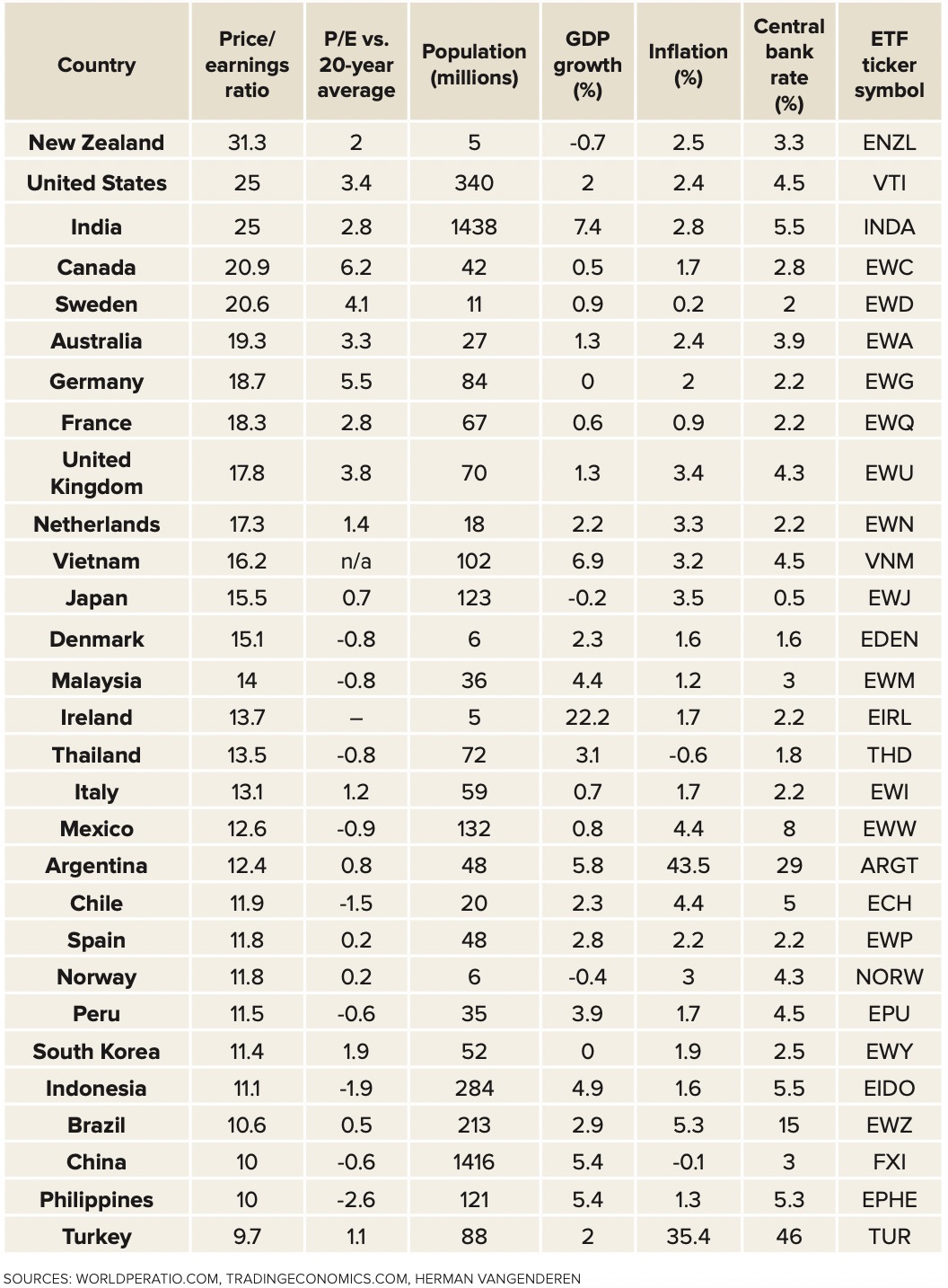

I found a great website, Worldperatio.com, that lists many countries and the price/earnings (p/e) average for their publicly traded companies. As a refresher, the p/e is the price you pay for a dollar of earnings. Would you sooner pay $20 per dollar of earnings, or $10? The lower the number, the better the valuation. The website also shows the current p/e in relation to the historic average p/e. For example, New Zealand has the most expensive stocks in the world, with an average p/e of 31.3, but surprisingly that is only 2.0 higher than its 20-year average p/e of 29.3 (31.3 minus 2.0). I don’t know why this market is so expensive and I’m not interested in buying New Zealand at this valuation.

More than 95 per cent of my investments are in Canada and the U.S. From the table shown here, you can see they both have high valuations and are trading well above their long-term averages. While Canada has a lower p/e than the U.S., it has the highest p/e of any country relative to its long-term average, now trading with a p/e of 20.9 compared to its long-term average of 14.7 (20.9 minus 6.2).

The columns for GDP growth, inflation and central bank rate were pulled from another terrific website, Tradingeconomics.com, which I use regularly. We need to be cognizant of these factors when considering investments in other countries. I searched up the current population of each country to add to the overall picture and included a ticker symbol for a U.S.-based exchange-traded fund (ETF) on each country. I plan on doing a little more work on Canadian-based worldwide ETFs.

Areas of interest

Argentina is an interesting country. Milei has been in power for just 18 months and has wrestled inflation down from 300 per cent to 43.5 per cent over the past year. This annual rate overstates the rapidly decreasing month-over-month rate now in the two per cent range. Italy is also interesting as Meloni has provided leadership stability to the historic musical-chair aspect of Italian politics. Both politicians appear to be providing sane economic policies to countries that had been economic basket-cases. Interestingly, both were labelled “far-right” by legacy media.

Ireland is also interesting in that it has had one of the strongest economies in the world over the past 10 years, partly due to low corporate tax rates attracting corporate head offices. However, it appears to have a volatile economy, with its current supersized growth following a significant recession.

China has attractive stock valuations, but I have no interest investing in this autocratic regime for numerous reasons. India is considered the new world growth driver, but its stock valuations are as expensive as those in the U.S. I will also pass on it.

Norway has an energy-based economy like Canada’s, but stock valuations almost half of Canada’s, trading very close to its long-term averages. It has managed its energy wealth exceptionally well and has a sovereign wealth fund of about $1.8 trillion. It looks attractive.

Other areas that look interesting are the populous Asian nations of Vietnam, Thailand, Indonesia and the Philippines. They trade at reasonable valuations, have good growth, inflation and interest rates.

Lastly, Latin America looks interesting. Mexico, Argentina, Chile, Peru and Brazil have good valuations, trading in line with their long-term averages. They are resource-driven economies, like Canada. I recently purchased iShares Latin America 40 ETF (ILF) that holds the largest 40 companies in Latin America. I generally use ETFs when investing outside of Canada and the U.S.

Emerging economies are considered to have higher political risk than developed economies, but I might argue that point in the current environment. Political risk is evident everywhere.