The course of Canadian farm equipment prices has moved from prediction with pencils to conjuring unknown forces — call it U.S. President Donald Trump’s wish list. It reminds one of how Sir Winston Churchill, speaking to Britain’s Parliament in October 1939, described what would be the course of the Second World War. “It’s a riddle wrapped in a mystery inside an enigma,” he explained.

That phrase nimbly captures prices for farm machinery in the summer of 2025. The turmoil is rooted in U.S. tariffs, of course, and that uncertainty cascades down to combines, harrows, tractors, trucks — you name it. Farmers, at the tail end of the process, are, well, very cautious.

Read Also

How a single-store family-owned ag equipment dealership prevails

A family-owned, single-store farm equipment dealership is increasingly rare. But the Sowa family at Wadena, Sask., say they have no plans to change thebusiness model.

Farmers are backing off buying new equipment, facing disrupted supply chains, unknown prices on old equipment on dealers’ back lots, cascading shutdowns of supply chains and slowing of production lines, according to a Nov. 20, 2024 news release from Farm Credit Canada.

“New equipment unit sales are projected to remain soft through 2025 as farmers feel the pressure of low commodity prices, high equipment prices and tighter profitability,” the federal lender predicted. It estimated combine sales will fall eight per cent in 2025 compared to 2024 sales. Moreover, farmers who hoped to beat the waves of tariffs variously threatened, debated and imposed have slashed pre-orders, put low crop prices in their crosshairs and started to wait out the price chaos to come.

—>READ MORE: Check out the latest on tariff threats HERE

As explained by a Saskatchewan dealer who prefers his name not be attached to his candour, “our yard is loaded up with pre-tariff product … We’ve priced sale for threatened duties, but if the tariffs don’t come through then we will have to sell at a loss. We’re locked into prices we can’t cut except at a loss and can’t raise for fear of order cancellation by our farmer customers.” This is a financial straitjacket for Canadian farmers and their suppliers.

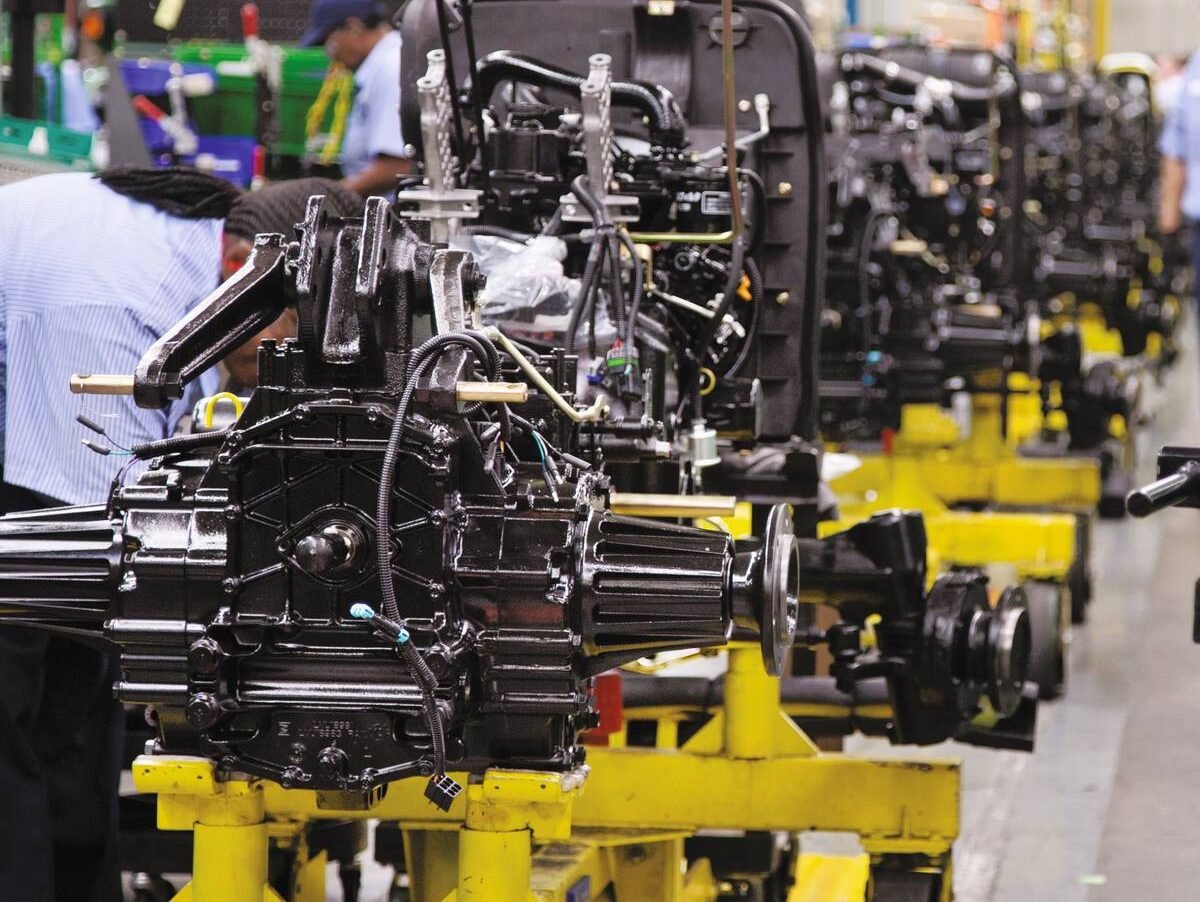

U.S. tariffs have spooked equipment sales — as have restrictions on purchases of crops such as soybeans that are in China’s crosshairs, already facing a 2024 hurdle on exports. Compounding the tariff problem is the reality that a lot of heavy equipment has components that have crossed borders many times on the way to final assembly. In these cases, border-hopping means new tariffs can be piled onto preceding tariffs.

Individual farmers are not equipped to predict single-nation tariffs, much less tariff cascades on machinery components from several countries. As Myrna Huber, a manager of family business Huber Ag Equipment at Coronation, Alta., says, “we let our equipment brokers deal with prices of tools we sell into the United States.” That is post-sale pricing. On the special goods she sells — for example, castrating tools — pricing is well anticipated by customers. That does not go for big-ticket products.

Chris Hergott, general manager at Hergott Farm Equipment Ltd. at Humboldt Sask., says “tariffs have slowed down the market for new equipment.” Will slower and lower new equipment prices cascade down to lower prices for used machinery? With dealers reporting higher prices for used equipment, especially row-crop tractors, back lots are looking sparse.

And that’s how it is playing out. Higher new-equipment prices, with crop values skinned by tariffs, are driving farmers to buy more used gear. New-equipment prices are published by manufacturers, known and relatively fixed; used gear costs are much more negotiable.

The unknowns remain machinery costs, chemical prices, seed costs and farmers’ understandable instincts not to get financially stretched when their bottom lines look downright fragile. Unless there are Canadian government bailouts that ultimately pay for U.S. tariffs, farmers are going to remain in the U.S. price vise.

The problem is that markets can usually work out supply and demand, but can’t set selling prices based on whipsawing politics. Every buying survey reveals cautious farmers and equipment dealers cutting back on orders. Efficiency isn’t the goal now. Rather, it’s keeping balance sheets in the black and avoiding politically-driven mayhem. It may be unfair, inefficient and precarious for every farmer laying out cash for equipment — or, for that matter, chemicals or seed — but it is the reality of the U.S. tariff war.