We’ve all the heard the expression “Cash is king.” It’s a catchy phrase, but what does it really mean and how can we practically apply that concept on farms today?

I submit what “cash is king” really means is to have money available to pay ongoing farm expenses such as crop inputs, wages, loan payments et cetera as they become due, and also to pay yourself and your farm family/team a monthly income that (at least) covers living expenses. I’ll only focus on actual cash flow in this article; I’ll have a brief comment about accrual adjustments at the end.

Read Also

Avoid these thought traps when investing

Investing for Fun and Profit: Let’s review a list, by renowned fund manager Peter Lynch, of the most dangerous things that stock market investors can say to themselves, or to others.

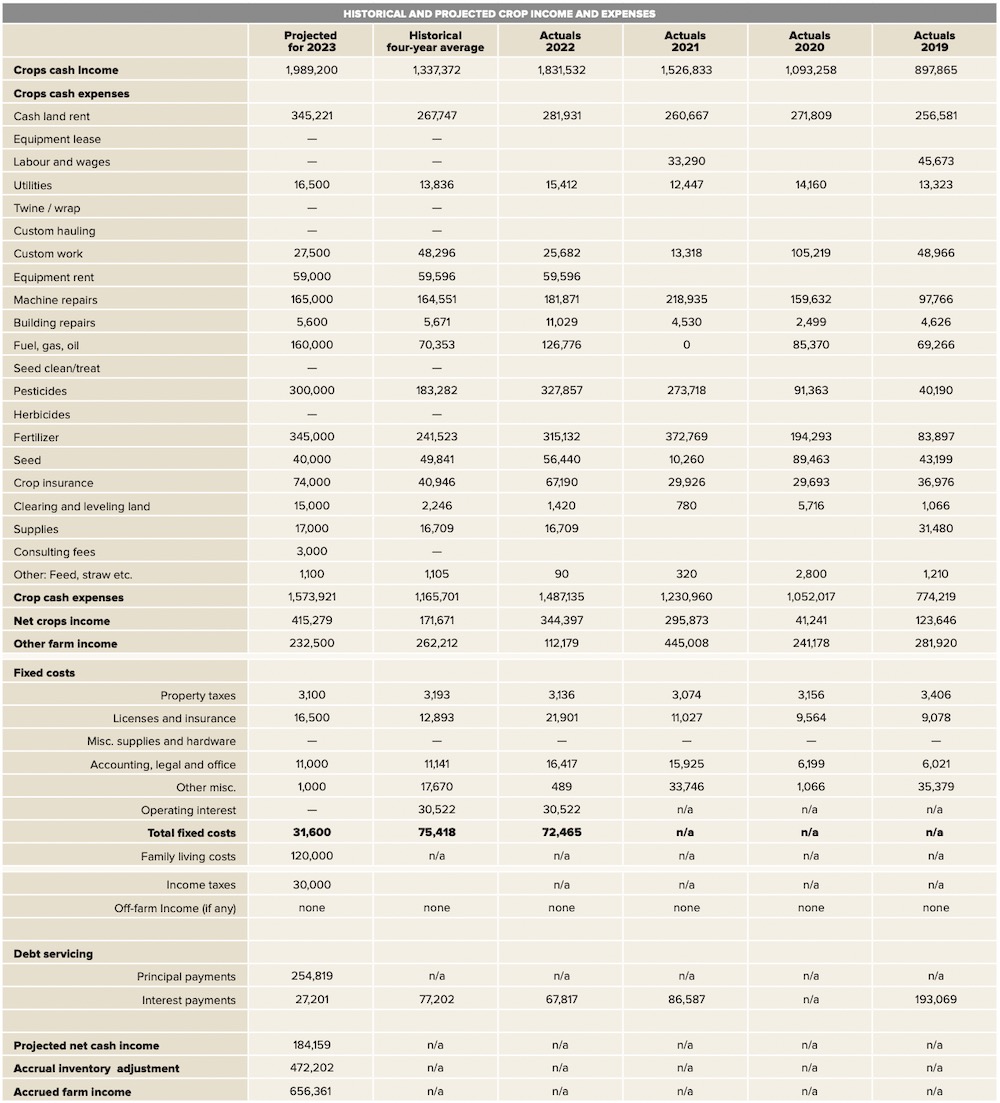

Where do you start to get a handle on cash flow requirements? A good place to start is to chart farm expenses by line items over the past three to five years. The table here shows a chart from 2023 that I recently prepared based on a real farm. Once you know your average historical expense for each line item, you can make some realistic predictions for the upcoming year.

Of course you have to adjust for increases in costs, changes in acres farmed, different crop rotations et cetera; then you have to do the same for the farm’s fixed costs, loan payments and personal living expenses. This example includes $120,000 for family living expenses, which is for two families.

You will notice in several cells there is no data. That’s quite common and you will likely have the same problem. I suggest you don’t worry about the missing details; work with what you have and make the best projections based on that.

On the income side, we can look at the historical income and calculate an average over the last three to five years. Since those are actuals, they should be a good guide for the upcoming year, but you should make detailed income projections for each crop you plan to grow. Then, multiply the acres of each crop by the estimated yield and market price to get the estimated dollar value. Once you have that, add the dollar values for each crop and calculate the total expected crop income.

Once you have total expected crop income and input expenses, you can calculate net cash income. From that, you deduct fixed costs, as listed in the table, and loan payments. On the income side are items to add as well: other farm income (such as gas and oil leases, program payments, patronage dividends, investment income) and off-farm income (if any). So, we finally come to the overall expected net income number, based on cash, for your projected year.

At the beginning I mentioned accrual adjustments — changes in the values of inventory from the beginning of your fiscal year to the end of it. In the case of the farm in the table, the farmer had $1,031,060 of crops in bins at the beginning of the year and was anticipated to have $1,503,262 at the end of the year. That’s an increase of $472,202, added to the net income for the year. It’s not cash, but it’s “money in the bins” which could be turned into cash. Bankers want projections based on accrual accounting since it gives them a more detailed picture of your financial situation, especially if you are decreasing inventories to maintain cash flow.

The next step would be to do a month-by-month breakdown for your projected income and expense items, so you can see your expected net position at the end of each month. I’ll leave that for another article, since that is a comprehensive topic on its own.

I have a spreadsheet program that does all the above and a lot more, called ABA (Agricultural Business Analyzer). It’s a really comprehensive farm financial analysis tool bankers really like; it’s good for your own information and for your lenders as well.

I also have access to a simple cash flow spreadsheet that does the basic month-end calculations mentioned above. You can use it once you know the total for each line item, then break them down into the monthly columns for income and expenses.

The important point is that you plan for the spring and summer, when you will most likely be in a deficit position and will have to make arrangements for that shortfall ahead of time; it’s likely to be higher in 2024, due to higher input costs and higher interest rates. Lenders do not like to be approached month after month for more credit. It’s a signal to them of inadequate financial planning.

Feel free to contact me for more information and I’ll explain how you can get free access to ABA or the simple cash-flow analyzer from Farm Management Canada.