During the third week of November, Alberta packers were buying fed cattle on a dressed basis in the range of $303-$305/cwt f.o.b. the plant for late December delivery. Live prices in Alberta were quoted at $178-$180 f.o.b. the feedlot.

Feedlots in Alberta and Saskatchewan are backed up with market-ready supplies of fed cattle. Carcass weights are sharply above a year ago. Alberta fed cattle basis levels are historically wide. Domestic processing plants have nearly 100 per cent of their December requirements covered and nearly 50 per cent of their January and February demand on the books.

U.S. processing plants have been actively buying fed cattle in the range of C$184-C$186/cwt f.o.b. the feedlot but this has done little to alleviate the backlog of market-ready supplies. Some trade estimates have pegged this backlog as of Nov. 1, 2022, near 50,000 head combined between Alberta and Saskatchewan. Many feedlot operators have called me over the past few weeks asking when this backlog of market-ready supplies will be cleaned up.

Read Also

Fall clean-up and bringing animals home at the Eppich ranch

Winter is approaching which meant emoving old fence rows and bringing livestock home before the cold and the snow at the Eppich family ranch.

Feedlots are backed up

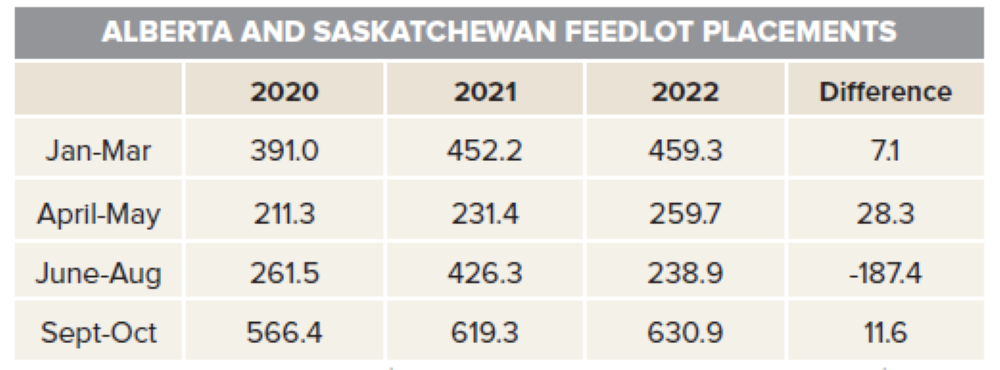

How did the fed cattle situation become so burdensome? There are two main factors. First, the drought during the summer of 2021 resulted in a surge of feedlot placements between June and August of 2021. In the accompanying table, we have the feedlot placements for 2020, 2021 and 2022 for the respective months. Notice that during June through August of 2021, Alberta and Saskatchewan feedlot placements were 426,300 head, up 164,800 head from the same period in 2020. These cattle were placed in the summer of 2021 and ready for the fed cattle market during the winter, five to six months later. As of Dec. 31, 2021, the backlog of market-ready supplies in Western Canada was estimated at 100,000 head.

Usually, this backlog can be alleviated simply by increasing fed cattle exports. Unfortunately, the current environment is not that easy to correct for several reasons. At the same time, U.S. processors have had sufficient supplies available in their local market with the weekly slaughter pace running near capacity. Alberta fed cattle basis levels have been historically weak throughout the fall. A traditional fed cattle basis is C$4/cwt under the appropriate live cattle futures con 391.0 verted to Canadian dollars. This past fall, the fed cattle basis was in the range of C$20-C$24/cwt under the nearby live cattle futures.

Looking at the feedlot place table again, notice that the June through August 2022 placements were down 187,400 head from the same period of 2021. It takes one full year or cycle for the fed cattle supplies to return to normal. Therefore, the backlog of market-ready supplies in Western Canada will likely be cleaned up at the end of February. Alberta packers have been showing some historically strong basis levels for April through June 2022 as they anticipate an extremely tight fed cattle situation on both sides of the border. The fed cattle market will transition from encouraging demand in January 2023 to rationing demand through higher prices during April 2023.

Earlier in the summer, U.S. 2022 fourth-quarter beef production was projected to drop to 6.7 billion pounds. However, the drought in the U.S. Southern Plains, along with the larger-than-expected cow slaughter, has caused 2022 fourth-quarter projections to reach more than 7.1 billion pounds.

The U.S. market also moves through a transition, but nearly three months sooner than Western Canada. U.S. beef production is expected to dip to 6.7 billion pounds in the first quarter of 2023. This is down 400 million pounds from the fourth quarter of 2022. The U.S. beef complex also moves from a burdensome supply situation in the fourth quarter of 2022 to a historically tight situation in 2023.

The 2023 U.S. third-quarter production is expected to drop to 6.5 billion pounds, which is a year-over-year decrease over 600 million pounds. Usually, the fed cattle market trends lower from April through June. During 2023, we could see a counter-seasonal trend during the spring. This will bolster feeder cattle prices during February and March.

Alberta fed cattle prices will remain relatively flat through January. Basis levels will start to strengthen in February and we could see Alberta packer bids reach fresh historical highs in March and April. This will enhance feedlot margins and drive demand for replacement cattle. Feeder cattle prices are expected to percolate higher from May through August 2023.

We continue to project historically strong feeder cattle prices on both sides of the border during October of 2023. I have been encouraging cow-calf producers to expand their herds by purchasing bred heifers or bred cows. Prices are a steal as these bred cows and replacement heifers will probably be paid for in one year.