Feeder cattle have been trading near historical highs over the past six months. I’ve received many emails and inquiries from cattle producers asking if there is still an opportunity to expand their herds. Producers also ask if they should buy now or wait until spring.

Medium-quality bred cows have been trading in the range of $2,400-$3,000 while average-quality bred heifers have been priced in the range of $2,700-$3,000. Good-quality bred cows and top-genetic bred heifers are $3,000-$4,000.

In finance, any asset is worth the present value of its future earnings, but this maxim doesn’t always hold water for cow-calf producers. The market can fluctuate quite significantly from year-to-year for the cows. Secondly, feed costs can be an inhibiting factor, as many producers in the Palliser Triangle and in Manitoba have had to buy hay to sustain their herds over the winter. In this article, we’ll discuss the fundamentals for the cow and calf markets over the next two years.

Read Also

Fall clean-up and bringing animals home at the Eppich ranch

Winter is approaching which meant emoving old fence rows and bringing livestock home before the cold and the snow at the Eppich family ranch.

High prices encourage producers to expand production. The year-over-year decline in beef cow slaughter is the first sign of expansion in the cow-calf sector. Official U.S. data has the U.S. beef cow slaughter from January through October at 2.938 million head, up 413,000 head from the same period of 2022.

The total beef cow slaughter for 2023 is expected to finish near 3.5 million head, down 528,000 head from the 2022 total of 4.028 million head. The year-over-year decline in the beef cow slaughter is sufficient to cause a marginal increase in the calf crop the following year. The U.S. 2024 beef cow slaughter will likely finish near three million head, down from the 2023 estimated processed number of 3.5 million head.

At this stage, we’re not seeing any sign of heifer retention. The U.S. auction market steer/heifer ratio is similar to last year’s, as is the slaughter ratio. The U.S. steer slaughter is running 700,000 head below year-ago levels while the heifer slaughter is only down 200,000 head from last year. Industry estimates suggest there will be about 100,000 heifers in the U.S. held over for herd expansion, which is not significant.

History tells us the U.S. cow-calf producer needs one year of historical high prices before heifer retention occurs on a larger scale. This points to 2024 as the main year for the turn in herd building from heifer retaining. We’re expecting the U.S. cow-calf producer to hold back nearly 500,000 heifers from 2024 into 2025.

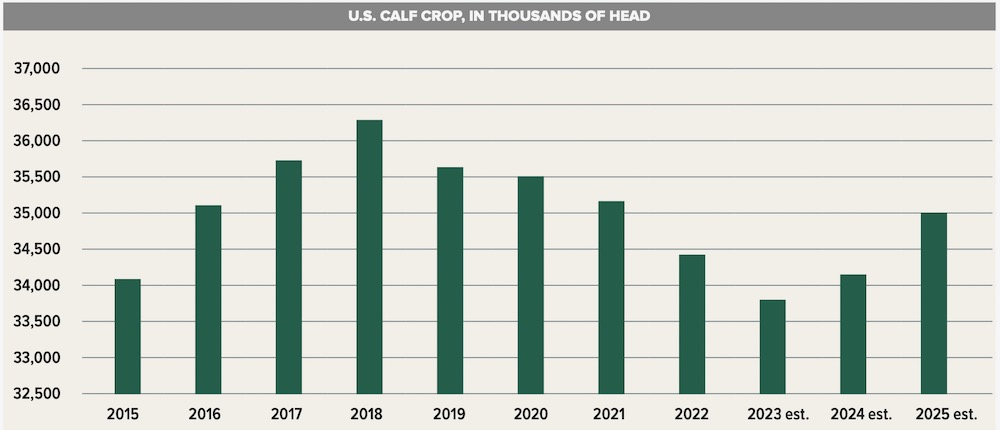

The U.S. calf crop during the 2023 calendar year is expected to finish near 33.8 million head, down 665,000 head from the 2022 calf crop of 34.465 million head. Accounting for marginal heifer retention and the year-over-year decrease in the beef cow slaughter, the 2024 calf crop is expected to finish in the range of 34 million to 34.1 million head. We’re only going to see a year-over-year increase in the calf crop of 200,000-300,000 head in 2024.

This isn’t significant enough to alter the price structure for feeder cattle, so producers can count on another year of historical high prices. Prices will not likely make fresh highs, but the market will remain elevated in 2024, similar to 2023. The main year-over-year increase in the U.S. calf crop will occur in 2025, with projections reaching 34.7 million to 35 million head.

The Canadian calf crop doesn’t move through the expansion and contraction like the U.S. Since 2019, the Canadian calf crop has hovered between 4.4 million and 4.5 million head, according to Statistics Canada. Over the next year, we may see the Canadian herd mirror U.S. expansion. The Canadian calf crop in 2022 was 4.446 million head; the 2023 calf crop is expected to reach 4.48 million head. Canadian calf output has potential to reach 4.5 million head in 2024 and 4.6 million head in 2025.

The difference between the 2015 expansion and the 2024 expansion is the increase in dairy-beef genetics. The industry does not need as many calves coming from beef cows with more dairy-beef crosses. We don’t have the actual statistics on this to use in market projections; the only point we can make is that the volume of dairy-beef calves is growing, not diminishing. This is providing a supply cushion to the beef calf cycle during lower production years.

This past fall, 500-pound steer calves in Western Canada were bringing back $400 per hundredweight, or $2,000, while 500-lb. heifer calves were returning $350/cwt., or $1,750. Cow-calf producers can count on these types of values again in 2024. The year-over-year increase in heifer retention could cause 500-lb. steer-calf prices to trade up to $425-$450/cwt. during the fall of 2024. A similar year-over-year increase of $25-$50/cwt. would be noted in 500-lb. heifer calves. The beef herd is at the beginning of an aggressive expansion phase which typically lasts about two years. Good-quality cow-calf pairs will have potential to average $5,000-$5,500 in the fall of 2024. Decent-quality bred heifers and young bred cows should average $4,500. We have two more years of strong prices for bred cows, bred heifers and calves.