Alberta packers were buying fed cattle in the range of $157-$158 during the latter half of September; this is up $3 to $4 from late-August values of $153 to $154. The fed cattle market is in a precarious situation. Beef demand tends to improve in the fourth quarter, however, fed cattle supplies from October through November are expected to be extremely burdensome.

Feedlot placements during the summer were sharply higher than year-ago levels due to the drought. The fed cattle market transitions from an extremely burdensome beef supply situation during the fourth quarter of 2021 to a rather tight supply during the spring of 2022.

Read Also

Harvest wraps up and fall work begins

At the Eppich famly ranch in western Saskatchewan, the fall harvest was successful with few breakdowns, cows and calves have been sorted and a new tractor has arrived

The feeder market has two major risks. First, fed cattle prices will struggle in the final quarter of 2021 and feedlot demand will be limited. However, during the first half of 2022, we’re expecting a sharp increase in Canadian feeder cattle exports to the U.S. Feedlot margins are expected to improve in the first half of 2022, and we expect live cattle futures to trend higher in the second quarter. Secondly, U.S. corn is trading into southern Alberta at $360/tonne which is a $40/tonne discount to current barley prices. Barley prices have downside potential. The barley market will trade in line with U.S. corn values over the winter.

Prairie feedlot placements up

Feedlot placements in Alberta and Saskatchewan from May through August were 534,700 head. This is up 181,800 head from the same period in 2020. This is bearish for the Alberta fed cattle basis during the final quarter of 2020. The earlier placement structure during the summer months will cause fed cattle supplies to be rather burdensome in the fourth quarter of 2021.

On the flip side, fed cattle supplies will be rather neutral in the first quarter of 2022 but then move to an extremely tight situation during the second quarter of 2022. Cow-calf producers need to hold onto their calves as long as possible. Try to sell your calves in December or even January or February. This may require holding the calves until they’re 800 to 900 pounds. Feed grain and forage costs are high but you will be rewarded. Feeder cattle supplies will be down from year-ago levels during the final months of 2021.

Feedlot placements from May through July were 5.32 million head, down 423,000 head from the second quarter of 2020. There wasn’t an increase in feedlot placements due to the drier conditions in the Northern Plains.

Prices begin to improve in 2022

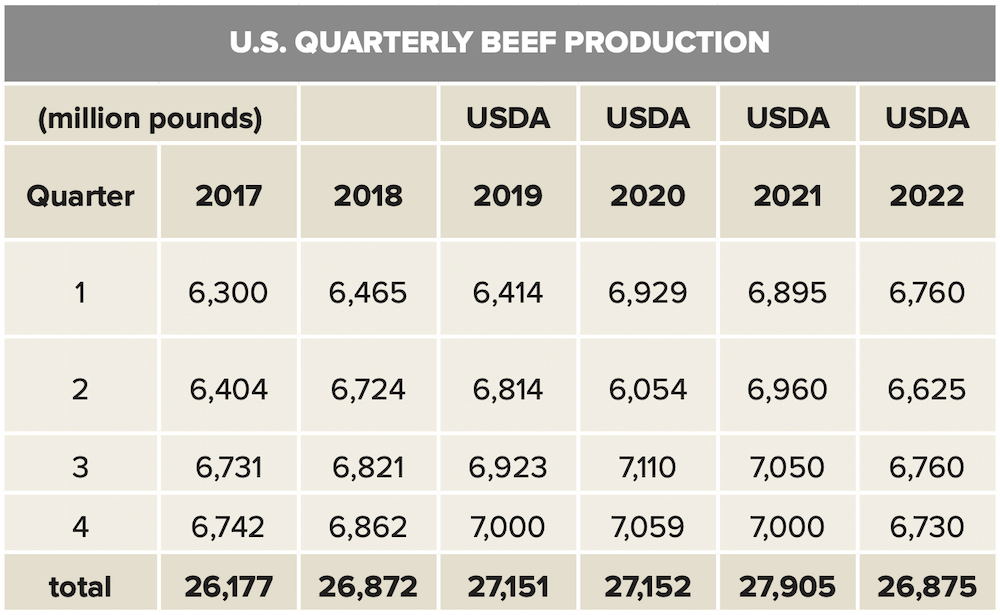

Without going into detail, U.S. beef production during the final quarter of 2021 will be similar to last year. This is a neutral outlook for the fourth quarter. However, in the accompanying chart, notice the year-over-year declines in quarterly production during the first half of 2022. Specifically, second-quarter beef production will be down 335 million pounds from the second quarter of 2021. This will result in historically high fed cattle prices. The cow-calf producer and backgrounding operator should sell their feeders so that the finishing feedlot can sell fed cattle market in the April/May timeframe. Better yet, you may want to think about placing your feeder cattle in a custom lot and retain ownership until the animal is finished.

Producers need to be aware that beef demand is inelastic. A small change in supply has a large influence on the price. Secondly, beef demand and consumer spending are highly correlated. Keep in mind that U.S. consumer spending is about 70 per cent of U.S. GDP. The equity markets and the live cattle futures often move in tandem for this reason. The U.S. economy is expected to reach the peak phase of the business cycle in the second quarter of 2022. (There are four phases to the business cycle which include, contraction, trough, expansion and peak). Beef demand will also peak in the April through June timeframe.

Longer-term, notice the beef production projections for the third and fourth quarter of 2022. Western Canadian weather patterns move in 18-year cycles. Remember, the weather pattern during the summer of 2004 was cold and wet. Feed grains were burdensome; there was a frost on August 19, 2004, which I clearly remember as I was a “local on the trading floor” at the time. Cow-calf producers and backgrounding operators need to be strategic. Plan to load up on grass cattle during the spring of 2022. Even better, start buying these featherlight bawlers this fall that will be yearlings in September of 2022.

The Alberta fed cattle market transitions from a burdensome situation during the fourth quarter of 2021 to a neutral market environment during the first quarter of 2022. Fed cattle prices are expected to trend higher into the second quarter of 2022. Feeder cattle prices are expected to trend higher during the winter. Next fall, calf and yearling values are expected to reach historical highs.