Feeder cattle prices across Western Canada have been quite volatile due to geopolitical issues. I’ve received many calls from cow-calf producers and backgrounding operators regarding the timing of feeder cattle sales.

Prices have varied significantly from week to week. For example, the price of 600-pound steers in Alberta varied recently by as much as $15 in just one week.

Earlier in January, feedlot operators in Western Canada struggled to secure the corn requirements due to extensive rail delays. After federal Agriculture Minister Marie Claude Bibeau intervened and called the CP Rail president, farmers and truckers took it upon themselves to block the Coutts border crossing. What were these people thinking? This blockade hindered imports of corn.

Read Also

Get ready for an eventual transition on cattle traceability

When new federal cattle traceability rules do ultimately take effect, reporting requirements will vary for producers, transporters, feedlots and markets — but most of the onus will be on producers.

Some feedlots had to delay fed cattle shipments to U.S. plants. After the protests were over, cattle producers were in shock once again to find that imported corn prices were $50/tonne higher due to the Russian invasion of Ukraine. Sometimes the news can drown out other vital information.

Statistics Canada released its cattle inventory survey on Feb. 28 and the data was viewed as constructive for the feeder market. Herd liquidation due to the drought wasn’t as significant as the industry expected.

The survey says

According to Statistics Canada, the total cattle inventory on Jan. 1 was marginally lower than last year but the number of calves born was actually up from a year ago. The total number of cattle in Canada on Jan. 1 2022 was 11.095 million head, down 0.6 per cent or 60,000 head from Jan.1, 2021.

However, the total number of calves born in Canada during the 2021 calendar year came in at 4.372 million head, up 22,000 head from the 2020 calf crop of 4.350 million head. The year-over-year increase was a surprise to the industry. It’s important to take a closer look at the information because the initial view doesn’t appear significant enough to have a market influence.

Statistics Canada does a good job of breaking down the data by province and farm type. In Manitoba for example, the number of beef cows on Jan. 1, 2022 was 363,300, down only 12,000 head from Jan. 1, 2021.

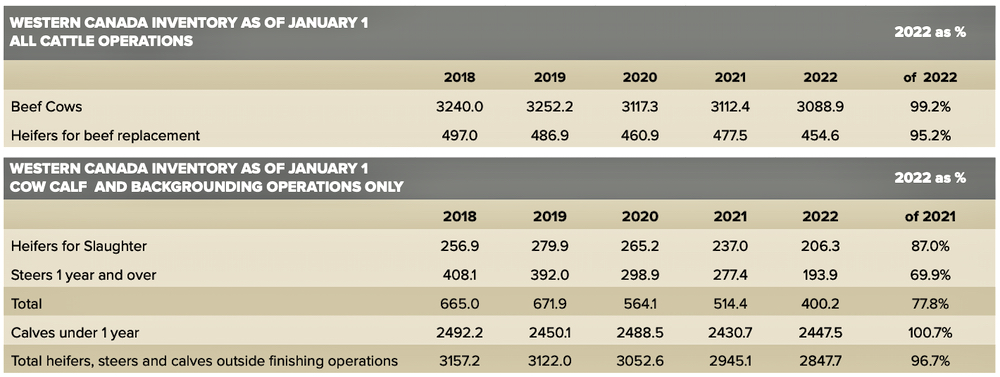

In Saskatchewan, the number of beef cows on Jan. 1 was 1.086 million, down only 4,800 head from Jan. 1, 2022. Alberta cattle producers were holding 1.420 million beef cows on Jan. 1, down only 17,000 head from last year. In all of Western Canada, there was 3.089 million head of beef cows as of Jan. 1, down only 23,500 head from last year. This isn’t significant enough to conclude that producers liquidated cows due to the drought — it’s a minor change due to market influences.

It appears that cow-calf producers are very resourceful. The number of calves under one year on cow-calf operations as of Jan. 1 came in at 1.966 million head, up 110,700 head from Jan. 1, 2021. There were 481,200 calves under one year old on backgrounding operations, down 79,700 head. Backgrounders were holding fewer cattle this year. Many of these operators didn’t feed cattle over the winter due to high feed grain costs and lower forage supplies.

The total number of feeder cattle outside finishing operations in Western Canada as of Jan. 1, 2022 was 2.848 million head, down only 97,400 head from Jan. 1, 2021. This is constructive to the feeder market moving forward. Cattle that would normally move into backgrounding operations were placed directly into the finishing feedlot. Total heifers for slaughter and steers one year old and over on finishing operations were counted at 1.104 million head, up 6.4 per cent or 66,000 head from Jan. 1, 2021.

As of early March 2022, the corn and wheat markets were incorporating a “war risk” premium due to the Russian invasion of Ukraine. During the last week of February, imported corn was offered in the Lethbridge area at $425/tonne on Feb. 28, while by the end of that week prices had jumped by $50-$60/tonne. Some feedlots that didn’t book their feed grains earlier pulled in the reigns on feeder cattle purchases. It’s been a custom over the past year for feedlots to lock in their feed grain costs and then buy the feeder cattle accordingly.

Ukraine and Russian wheat exports are 30 per cent of the world wheat trade. Russia isn’t significant for corn but the Ukraine market share is approximately 15 per cent of world corn exports. This is based on USDA 2021/22 projections.

Looking ahead, the concern is about the 2022 crop production year. Supply chains and export operations have come to a standstill in both countries. This comes on the heels of drought in Argentina and the second corn crop in Brazil is being seeded. It’s difficult to forecast how the feed grains market will develop moving forward. One thing for certain is that the feed grains complex will remain volatile and have a direct influence on feeder cattle prices moving forward. It’s important to have a prudent risk-management strategy.