Canadian farmers could be in a tough economic year according to Farm Credit Canada despite the Bank of Canada’s more optimistic analysis.

The Bank of Canada recently called the Canadian economy resilient in the face of trade woes and kept its key policy rate steady at 2.25 per cent. It noted that third quarter annualized GDP grew by 2.6 per cent, much more than expected.

However, a recent FCC report predicts Canada’s economy decelerating due to factors like interest rates, ongoing trade uncertainty and voluntary country of origin labelling (vCOOL).

Read Also

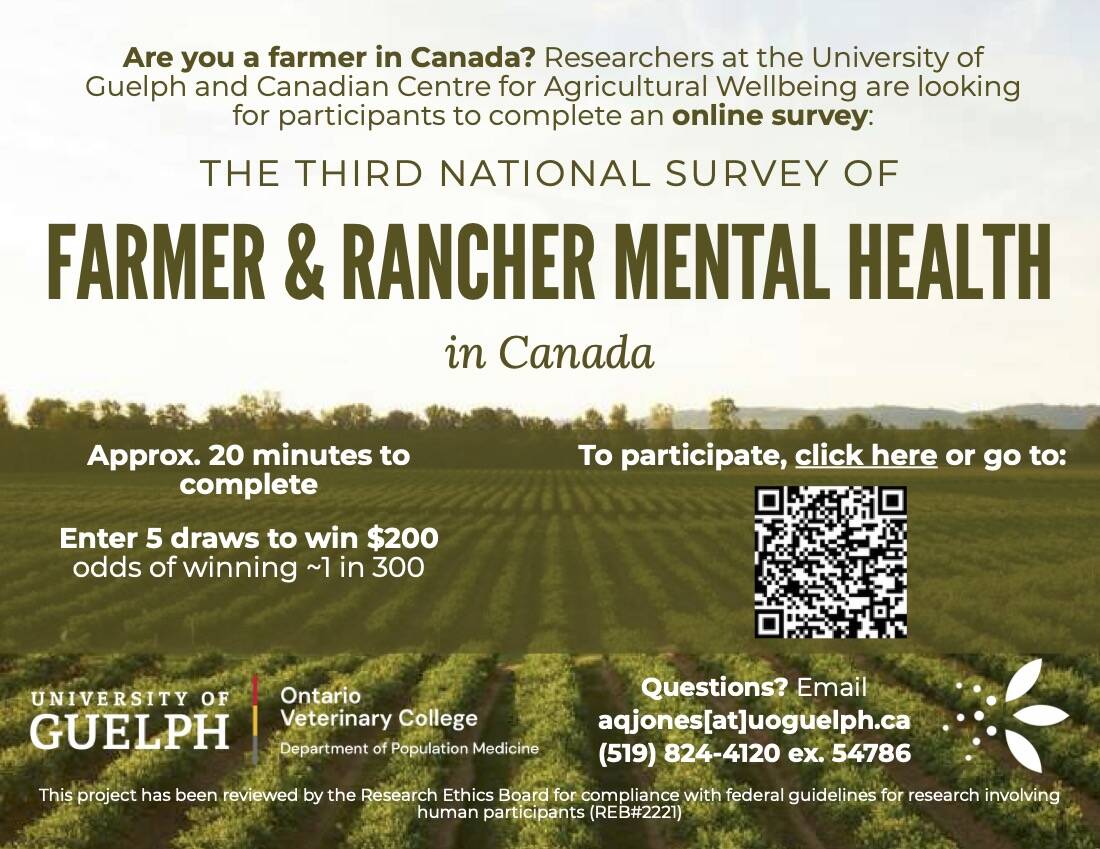

National survey of farmer and rancher mental health launches

The Canadian Centre for Agricultural Wellbeing has launched its third National Survey of Farmer and Rancher Mental Health in Canada.

“The message there was basically that maybe there’s a little bit of complacency in the markets,” said Krishen Rangasamy, FCC’s principal economist and the report’s author.

Interest rates

He said there is a chance interest rates will go down next year. This is likely to affect farmers, who are heavy borrowers. The report cites several complications for residential construction, which accounts for about eight per cent of Canada’s economy.

“Even though the Bank of Canada, in our view, should probably lower rates next year … long rates are probably not going to change a whole lot from here.”

Rangasamy said this is related to Canada’s bonds being closely linked to U.S. treasuries.

“’Oh, the Bank of Canada is lowering rates. Why isn’t my mortgage rate falling? I’m about to renew, and it’s still high.’ Well, then that’s the answer, right? So, you’re borrowing at the long end of a yield curve, not at the short end.”

The five-year bond rate is at three per cent. Five years ago in 2021, it was one per cent.

“Which tells you if you originated five years ago in 2021 and you’re going to renew in 2026 what’s going to happen? You’re going to renew at a higher rate, a way higher rate than what you originated at,” said Rangasamy.

“Whoever is going to renew next year a fixed rate product at the longer end of a yield curve, it’s going to be painful.”

Business confidence decreasing

Investment intentions over the next year are also predicted to drop, as the report shows business confidence decreasing in Canada.

The cloud that is uncertainty with the U.S. is expected to continue to cause problems.

“At the moment it looks like it’s going to stay there for 2026,” Rangasamy said.

The report predicts that “as the impact of the AI investment boom fades, cracks formed by the White House’s policies on tariffs and immigration will become more visible stateside.”

This could lead to a drop in demand for exported Canadian goods, 70 per cent of which are purchased by the U.S.

“Any drop in U.S. demand will have repercussions on this side of the border,” the report states.

One factor could help ease trade tensions: negotiations on the Canada-United States-Mexico Agreement (CUSMA) are set to begin next summer. Rangasamy said it is possible, even likely CUSMA will be renewed. Until anything is certain, the cloud will linger.

“That’s one of the reasons we’re not that optimistic about the rebound of business investment in Canada,” he said. “One thing businesses don’t like is uncertainty, and that U.S. trade policy is certainly wreaking havoc in that regard.”

Country of origin labelling

Another potentially aggravating factor is voluntary country of origin labelling (vCOOL) rules in the U.S., set to come into effect Jan. 1.

Canadian commodity groups say the vCOOL ruling could limit their access to American markets.

“There’s anecdotal evidence and some newspaper clippings that some farmers are already seeing a drop in demand from the U.S. ahead of that vCOOL being implemented,” said Rangasamy.

He said previous similar regulations harmed Canadian agriculture, particularly the hog sector.

Mandatory country of origin labelling (mCOOL) “went away in 2015, and we recovered a little bit, but we never went back to pre-mCOOL (mandatory country of origin labeling) levels,” he said.

“If you look at history, there’s a precedent where U.S policy basically causes permanent damage, even if it was it was removed afterwards,” he said. “If you take this as a guide, well, that’s not a great sign.”

Weathering the storm

Though FCC’s forecast may look dire, Rangasamy said it is “not all doom and gloom” and offered some suggestions for producers in the year ahead.

The first piece of advice is to boost productivity as much as possible.

“Make sure you’re lean, because … you’ll be in a better position to weather the storm,” he said. “You can’t control the external forces. What you can do is control your operation. So stay lean, seek productivity improvements wherever you can.”

Knowing costs of production is also crucial, as it can help producers take advantage of market movements. Rangasamy used the recent volatility of canola prices as an example:

“Markets sort of overreacted for two, three months,” he said. “Let’s say you’re a canola producer, so you know what your cost of production is, and as soon as you see prices go up and up towards a certain level, you say, ‘hey, I can lock this in.’”

“All this is a good thing, but also very important is to know your cost of production, to take advantage of volatility, because there’s always volatility in commodity markets, but more so with trade policy.”