Annuities are life insurance running in reverse. Rather than paying a premium for benefit at the death of the insured, an annuity stars with a lump sum and pays out income until the death of the person getting the money, the “annuitant” in annuity-speak. Payments will sometimes last longer than a lifetime, if there are guaranteed minimum numbers of payments or another person to get payments after the death of the annuitant.

The company issuing the annuity would prefer a sooner death, to cut short the payments of the simplest life annuities with no guaranteed minimum number of payments. Annuities are a mirror image of life insurance, in which the insurance company would like the person insured to live as long as possible, delaying payment of benefits.

Read Also

Avoid these thought traps when investing

Investing for Fun and Profit: Let’s review a list, by renowned fund manager Peter Lynch, of the most dangerous things that stock market investors can say to themselves, or to others.

Annuities have a curious history. They existed in the Middle Ages but they were often annuities in kind, for example, the right to hold land for the life of the beneficiary. In a financial setting, tontines — asset pools with income paid to surviving members — were sold by governments to raise revenue. Investors paid a sum to the government for the right to receive income and, at the death of an investor, his or her share would be reallocated among the surviving investors. Tontines led to much mischief, as you can imagine, for it paid to be a survivor. Tontines are not available in Canada for good reason.

In Canada, there are a handful of annuity varieties. None have incentives to do in other members of the pool. Each annuity is sold individually — what others do or how they fare has no bearing on what the annuity pays.

Annuities in Canada are just investment devices. You pay a lot of money for what, at present interest rates underlying the annuity, will be a trickle of income, For most people retiring with a fixed sum of capital, the annuity provides a rock solid guarantee of income backed by the insurance industry bailout fund called Assuris that will pay annuitants even if the insurance company becomes insolvent. It happened with Confederation Life when it became insolvent in 1994, but no annuitant lost money.

Canadian annuities are based on government bonds. At present, government bonds pay little so annuities have low payouts. Were government bond interest rates higher, annuities would have more appealing incomes. Annuities almost never cover inflation. Such coverage would reduce what they pay to a trickle. However, if one buys a ladder of annuities, say one every few years, inflation is automatically indexed.

The practicalities

Once you are in and getting paid, backing out of an annuity is difficult or impossible. Because annuities function under life insurance law, the payments have limited protection from lawsuits, though not tax claims by the Canada Revenue Agency. In sum, annuities are very useful for providing a known income for the life of the person receiving the money. They are a lousy way to build up savings late in life and usually a lousy way to receive savings in late life.

There are almost as many annuity structures and payment possibilities are there are pebbles on a beach. They vary by age of annuitant(s) at start of payments, guarantees of payment, jurisdiction, gender, immediate or deferred start, tax structure, and number of lives until end of payments.

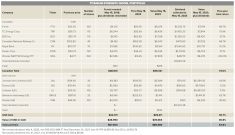

Here are some examples from current annuity rates based on $100,000 starting capital. These are representative quotes. In actuality, there is a range of prices among insurance companies:

- Male, age 60, simple life annuity, no guarantee: receives $473 per month.

- Male age 70, simple life annuity, no guarantee:receives $633 per month.

- Female, age 60, simple life annuity, no guarantee: receives 432 per month.

- Female, age 70, simple life annuity, no guarantee: receives $559 per month.

If we add up the payments by year, for male at 60, the payoff is $5,676 per year, for a woman $5,184 per year. Displayed as interest, it’s 4.73 per cent and 4.32 per cent at 60, which is more than a savings account or GIC pays these days. But the annuity is illiquid, irreversible, and, with our example of no guarantee period, results in confiscation of capital at death. These are crap shoot odds and, personally, I would not take them.

If you add a guarantee period of 20 years, the payoffs drop to $434 and $493, respectively, for men and $413 and $475, respectively for women.

If the survival factor is reduced or eliminated for the guarantee period, the annuity pays less. These are term certain annuities. Thus a term certain for either gender at age 60 for 20 years pays $521 per month or $125,040 over the term of the annuity. That’s $6,252 per year or 6.25 per cent in crude interest disregarding potential compounding of payouts and the eroding capital base. It’s not bad, but when the 20 years are up, all the capital is gone and the payments stop.

The discouraging returns and retention of initial capital is less onerous when you consider that part of the return of the annuity is capital. That makes the crummy returns a lot more attractive.

Consider an annuity for $100,000 up front purchase price paid by a 70-year old man. He would receive $6,880 of income each year of which $1,000 would be taxable income. This tax advantage can be compounded by buying a ladder of straight life annuities. The payout increases with each year you get older and the relative tax advantage over straight interest grows as well. Annuities are for those who don’t want their capital back but who do want bulletproof guarantees of income.

Annuity calculations are designed to expend all capital at some defined time. The Department of Finance incorporates the annuity idea into Registered Retirement Income Fund tables. They have increasing payouts and are thus not pure mathematical annuities. For RRIFs established before the end of 1992, they start with payments of four per cent at 65 and 20 per cent at 96 and thereafter. Pure insurance annuities have constant payoffs, although in other countries, annuities can be structured to carry investment risk and therefore to pay more or less than the mathematically determined rate.

The upside of annuities is that they leave no risk for the annuitant other than inflation. That can be covered by buying a ladder of annuities with payouts rising alongside interest paid on the government bonds that power them. As to security, even during the Great Depression, not one insurance annuity failed. But there is a hidden cost in annuities: commissions. They are embedded in the rates, hard to figure out, and, alongside the lack of ability get your money back after the annuity starts, they are negatives.

Bottom line: annuities can be a solution for the elderly, for the infirm and even as a way to put a floor under a retirement income, leaving the annuitant to take on stock market risk without the danger of running out of money and winding up poor. If the annuity idea appeals to you, check with a financial planner and price a few annuities with independent insurance agents. The homework will be worth it.