Over the past decade or so I have gathered up data on wheat and land prices in Saskatchewan and converted them to current dollars. That way, we can better judge how we are doing compared to our ancestors. History has a way of repeating itself, so a look back can suggest what might return.

I use Saskatchewan data just because that is what I can lay my hands on. In past columns, the Saskatchewan Agriculture website has come up for sharp criticism. The Ag Ministry got caught up in a backward step because IT types wanted a uniform “look” across the board.

Read Also

AgraCity’s farmer customers still seek compensation

Prairie farmers owed product by AgraCity are now sharing their experiences with the crop input provider as they await some sort of resolution to the company’s woes.

It is my great pleasure to report that the Ag folks have been able to put back much of the purged data and it is more easily accessible. Thanks gals and guys for that!

Net farm income: The bottom line

It’s one thing to talk about grain, input and land prices but it is the bottom line that pays the mortgages, buys the fancy equipment, and pays for inputs. What is left over from all that is what farm families can use for living and fun.

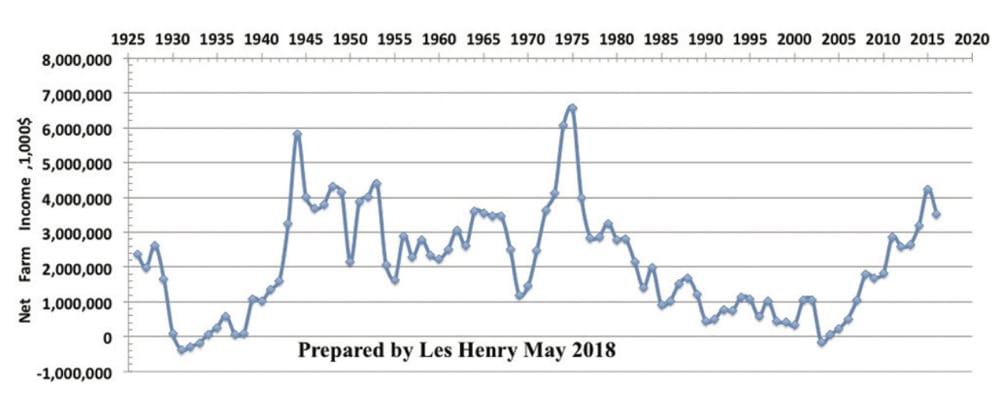

The Saskatchewan net farm income chart (below) shows the bottom line from 1926 to 2016, all corrected to 2018 dollars. It is no surprise that 1931 was the low point. While 1942 is often quoted as the “mortgage lifter” year the actual peak year was 1944.

The low point in 1969-70 was caused by a one trick pony (wheat) and no sale for a world excess supply. Those long enough in the tooth will remember 1970 when the Government of Canada paid farmers to summerfallow two years in a row. The program was called LIFT (Lower Inventories for Tomorrow). It was a disaster but the government of the day was trying to respond to a serious income deficit on prairie farms.

The sharp peak in the mid 70s was the result of a meteoric rise in wheat prices and market access. I was actually surprised to see that we are still well below the 1975 and 1944 peaks.

But it is all about net income. My good neighbour, Henry Block (1940-2011), told me about the new Lincoln car he bought in the mid-’70s with all the bells and whistles. The cost was a small boxcar of wheat — about 1,500 bushels as I remember. That amount of wheat today would not even buy a stripped-down Ford Focus.

The big decline: 1975 to 2005

In past columns I have made a case for a 30-year cumulative net drought from 1975 to 2005. That conclusion is based on continuous water well records for surficial aquifers for that time period.

We still managed to get some good crops in those years depending on the rain. There were also problems with price and market access but canola and pulses were common by then. But, if we have no grain to sell the price does not matter much — red ink was the result.

If we had net income records back to WWI, I’m sure 1915-17 would eclipse anything we see on this graph. Wheat was $35/bushel in 1917 (in 2018 dollars) and costs were very low, so profits were huge.

The big jump: 2015 to 2016

The rapid rise of the past decade is all about many irrigation years in a row, with Mother Nature providing the water with no charge. Pulse crop and canola prices and market access have also been a big factor.

Modern agronomy with proper fertilizer, good varieties and weed control have also been big factors. In recent years canola prices and the low Canadian dollar have been our saviour. But, all the best agronomy means nothing if the soil is dry and it does not rain.

The good crops of 2015 and 2017 with poor rain have many folks patting themselves on the back about good farming practices. Truth be known, the soil full of water is the first need when timely rains fail.

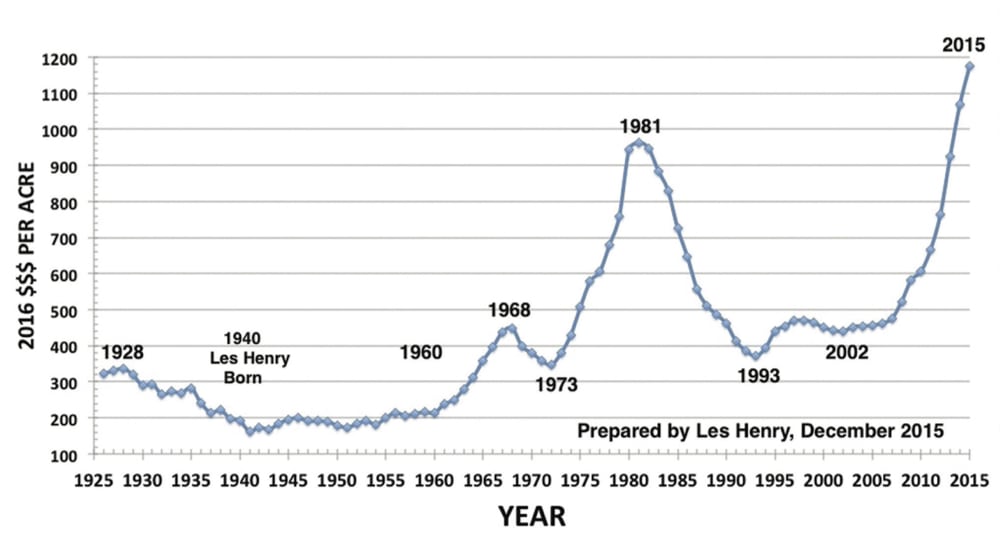

Saskatchewan land prices

It is interesting to compare Saskatchewan land prices to the net income graph. We are definitely in new, uncharted territory and in my opinion, setting up for a fall. Current land prices are not sustainable, in my opinion. Outside buyers are part of the problem but the big push is still the serious money farmers have made in the past decade.

Many say “this time is different.” The only thing different is the calendar and the fact that a small percentage of the super-priced land sales are taking place with farmer buyers cutting cheques or outside capital buyers, that see land only as a commodity.