As I write this, it has been 28 days since the full-scale invasion of Ukraine by Russia. The invasion continues to take a terrible, direct toll on the people of Ukraine. Daily, the direction and events of the war change dramatically as Russia continues its attacks on Ukrainian citizens and infrastructure. Ukraine’s agriculture sector is also being directly affected by the war and because Ukraine is the world’s fifth-largest exporter of wheat (as well as a major exporter of other grains and oilseeds), world wheat markets are and will continue to be affected by the invasion.

Read Also

Health hazards are often overlooked risks on the farm

While quite different from the dangers posed by farm machinery, hazards such as loud noise or sun exposure require the same proactive attention, the Canadian Agricultural Safety Association says.

“In terms of marketing in a war, as an analyst, I have never been through a war where the major combatants are large agricultural exporters. There is no way of predicting this outcome. The market tries to every day.” Those were some of Bruce Burnett’s first comments on the volatility of markets due to major events happening this year and, particularly, the past month, during a MarketsFarm webinar on March 17. During his presentation, the MarketsFarm director of weather and market information addressed the wheat outlook and market volatility due to the rapidly changing events in Ukraine.

“Today is the perfect example. Yesterday, peace was on the horizon. The markets sold off. And today, again with some statements from the Kremlin (and) from the Ukrainian president, it looks like peace is off for a while, so the market’s certainly gaining some momentum today from this. It’s one of those things where you’re not going to be able to predict it from day to day.”

However, Burnett does predict the war and its effects on markets may last longer than some think. “MarketsFarm believes the war is probably going to continue longer than the market currently believes. This is because of the fact that it does look like peace is going to be a hard thing to happen in the region. Many experts had thought the invasion would be over by now. That certainly doesn’t appear to be the case,” he says.

“I think, especially when it comes to agriculture and the disruption of exports, (the war) is going to last longer than the market currently expects. The major agricultural regions of Ukraine are essentially in the war zone.”

Ukraine grows soft white and red wheat, depending on the area, says Burnett. “It’s a soft wheat so it’s not particularly exchangeable, let’s say, with CWRS in terms of the people who would buy this — but it certainly will impact the market.”

Roughly 75 per cent of the production area in Ukraine is part of an active military engagement. Exports from Ukraine will be “extremely limited, especially if this war goes on longer because nothing is being shipped out of Ukrainian ports. They are exporting some by rail, but that’s going to be a relatively small market — they’ve obviously got other things on their minds than exporting grains at the present moment. This is going to be a major impact on the wheat market,” says Burnett.

In its March wheat export forecast, USDA dropped Ukrainian exports by four million tonnes to 20 million due to the conflict. This is not next year’s data, adds Burnett, it’s for this year. “You have to remember that most of the exports from the region have been executed essentially so far because we’re close to new crop, especially for the winter wheat crops in this region. Their crop year generally starts in the beginning of June, the international marketing year.”

Russia won’t have the same kind of production difficulties, says Burnett. Its exports are probably going to be limited or restricted because of a number of factors, “mostly around the sanctions that have come in, but it’s not going to be nearly as large an impact as, let’s say, the Ukrainian impact.” USDA’s March wheat export forecast dropped Russian exports by three million tonnes to 32 million.

Prairie weather outlook

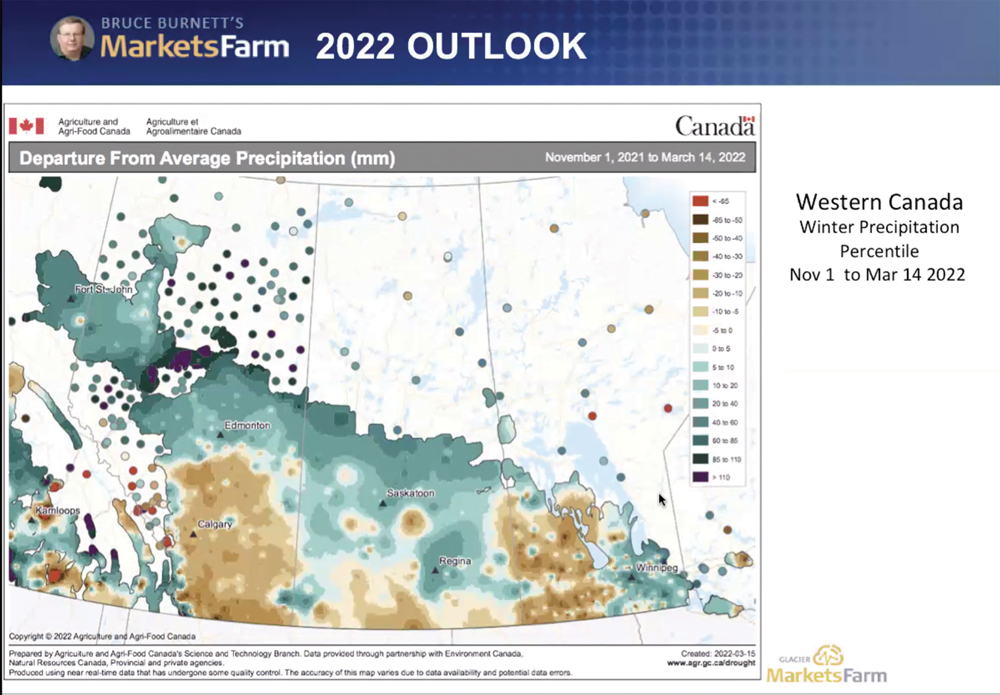

Burnett also discussed the weather outlook for Western Canada. The La Niña event this winter has followed a more typical weather pattern. Through most of the Parkland region, this has resulted in above-normal precipitation. Meanwhile, the central and southern regions of the Prairies have been drier than normal, which will continue.

“With the La Niña continuing here, the weather pattern looks to be for continued drier-than-normal conditions, for those southern and central regions through the end of March and into April. That’s a concern,” says Burnett. “We’re finally seeing some mild temperatures move into the Prairies. Out in the western areas, we’ve had a relatively mild winter but on the eastern side of the Prairies, it has been quite brutal.”

Mild temperatures have eroded the remaining snowpack in the southern and central regions, Burnett adds. What does this mean for planting? The good news is the snow will likely be gone by the time you read this column, but the bad news is, “we didn’t replenish much of that dry subsoil moisture condition,” he says.

As you can see on the map above, northern growing areas across the Prairies have had above-normal snowfall. Central areas of Saskatchewan had a little above-normal or close-to-normal precipitation. Central and southern Alberta received below-normal precipitation as did areas across most of southern Saskatchewan, except for Cypress Hills. Areas of western Manitoba also received below-normal precipitation. “Again, not a great setup for going into planting this year in those southern growing areas,” says Burnett.

“A lot of the northern growing areas still had very, very dry subsoil moisture from the drought last year. Those areas will still have a deficit. The second point to make out is we do not get all of that snow into the soil moisture profile. It depends on how the snow melts. We can only hope that it is a slow, steady melt, where we can get most of this snow in the northern areas … into recharging parts of the subsoil — that’s not a guarantee.” If snow melts quickly, the extra winter precipitation will replenish only a portion of the deficit.

For those southern growing areas, Burnett says, due to below-normal snowfall this winter combined with the drought conditions last year and severe subsoil moisture deficits, “we really, really need spring rains.”

Although he doesn’t put much stock into long-term forecasts, Burnett says there’s a chance the first half of Environment Canada’s precipitation forecast for April through June may be accurate, which predicts below-normal spring rainfall in southern Alberta and southwestern Saskatchewan and stretching up into the central areas. “This is something we’ve got to keep a very, very close eye on.”

The one thing that’s clear as you prepare to start your spring operations over the coming weeks is you are seeding into uncharted territory. We have not experienced this level of uncertainty on so many fronts before and most of it is due to things beyond your control. That’s what makes it all the more important to concentrate on what you can control.

In my next column, I’ll dive deeper into the wheat outlook and how it will affect you.

Take care,

Kari