Approximately a year ago a column titled “The value of target prices” studied analyst price targets on every TSX index stock with how the stock actually performed over the next year. Analyst target prices had been conveniently amalgamated in a Globe and Mail article. While I had never used target prices to make purchase or sale decisions, I thought the project would be worthwhile to see if my gut feel had been accurate. I was surprised by how wrong the target prices turned out, with the caveat that it was only one year of data.

Another year has come and gone, and I wanted to verify or refute last year’s observations. I was less surprised by the results this year as they mirrored last year’s pathetic accuracy.

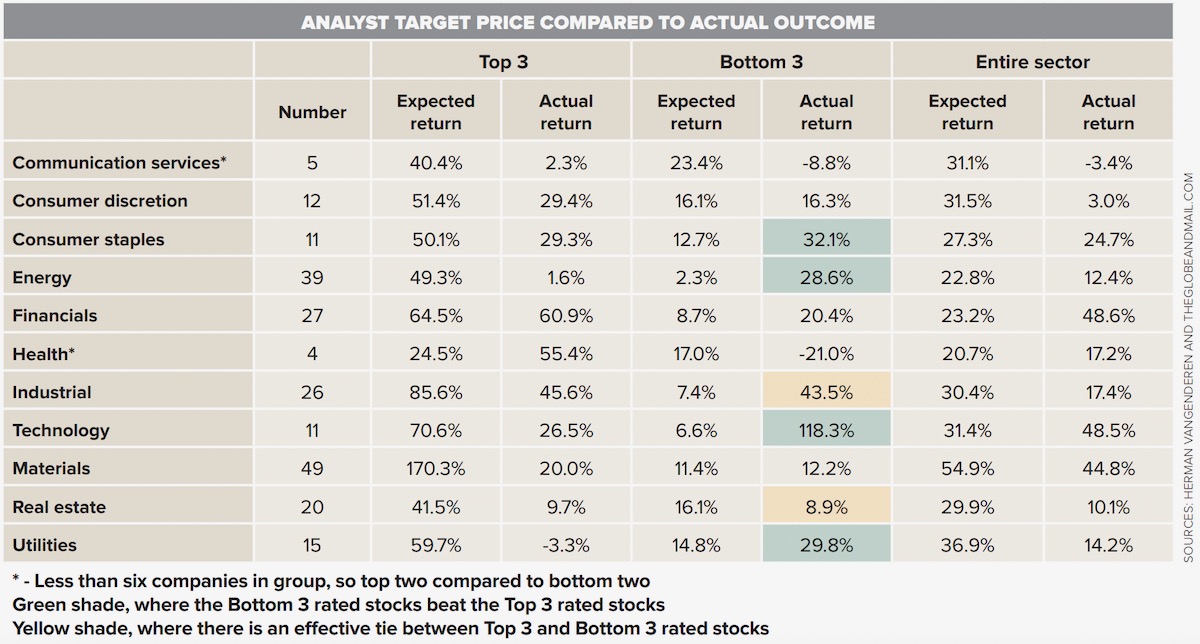

Like last year, I compared the top three-rated companies with the bottom three-rated companies within a sector. The chart also includes an average for the entire sector, but with those averages large errors on the positive side are often offset by large errors on the negative side.

Read Also

Is the technology in our vehicles a help or a hindrance?

Not only does new tech allow people to operate vehicles and farm machinery with fewer skills, it also creates more problems for vehicle users when those systems fail, Scott Garvey writes.

Last year, the bottom three-rated companies outperformed the top three-rated companies in five out of 11 sectors. This year, only four sectors had the bottom three outperform the top three but two more were effectively tied. Even where the top three performed better than the bottom three, there was often a huge gap between expected returns and actual returns. In communication services, for one, the average expected return was 40.4 per cent and the actual return was 2.3 per cent.

The prize for inaccuracy on the negative side was Lithium Americas, which had an expected gain of 120 per cent but achieved a loss of 76 per cent. If there were only a couple of analysts, the variation could be a random error, but 16 analysts contributed to the embarrassment. The biggest positive error occurred with Celestica, which was expected to decline by four per cent but went up by 275 per cent. Seven analysts contributed to that egregious miss. As I concluded last year, I will continue to ignore analyst target prices when making decisions.

This kind of prognostication miss isn’t the exclusive purview of Canadian analysts. It is a little too early, at time of writing in late November, to do a complete debrief on last year’s predictions. However, barring an incredibly fast correction in December, Wall Street analysts missed the mark by a wide margin for the second year in a row. The average of the big bank projections was for the S&P 500 to gain 1.9 per cent, with a range from negative 12 per cent to positive 13.2 per cent. At the time of writing the S&P 500 was up 25.5 per cent. While I didn’t nail it like in 2023, my prediction was still amongst the best of the U.S. analysts.

In 2023, the Wall Street average prediction was a loss of two per cent, and in 2024 the average was a gain of 1.9 per cent. Any investor that sat out both years because of these pessimistic projections would have sat out gains of 55.9 per cent as of late November. Knowing no one, including myself, can make accurate predictions with regularity, I simply remain fully invested all the time. On a long-term basis, stocks blow the doors off bonds and cash, as long as we can tolerate the fluctuations.

My main prediction every year is that most predictions will be wrong. I nailed that one! In the words of Ray Dalio, founder of Bridgewater Associates, “He who lives by the crystal ball will eat shattered glass.”