Fed and feeder cattle prices have been ratcheting higher over the past month due to stronger-than-expected demand.

Consumer confidence reached record highs in October and U.S. third-quarter GDP also came in above expectations. This economic data confirms that consumer spending is stronger than anticipated, enhancing overall beef demand.

Alberta packers were buying fed cattle in the range of $148 to $150 in mid-November, up approximately $10 from a month earlier. Feeding margins have improved and renewed optimism has flowed into the feeder market. Available feeder cattle supplies will decline in December and January and with the equity buildup in the feedlot sector over the past year, the feeder market will remain hot.

Read Also

Get ready for an eventual transition on cattle traceability

When new federal cattle traceability rules do ultimately take effect, reporting requirements will vary for producers, transporters, feedlots and markets — but most of the onus will be on producers.

In southern British Columbia, the Canadian satellite recap had a larger group of Charolais-cross 500-pound calves trading for $266; heifers weighing 465 pounds reportedly sold for $229. These feeders don’t quite pencil out but feedlots and backgrounding operators need to secure ownership before the end of the year.

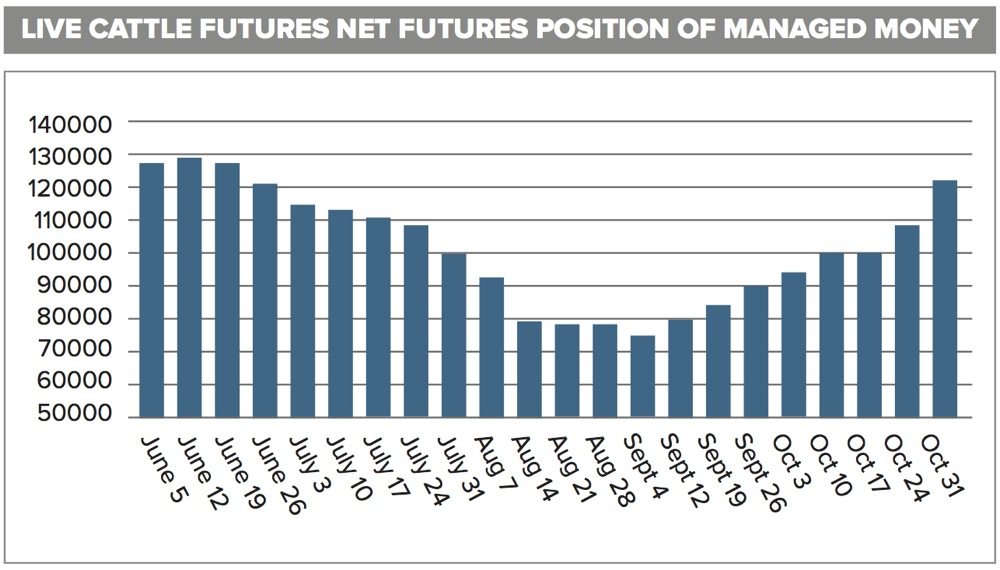

In the November column, I mentioned that producers should watch the speculative fund activity for an indication when to purchase price insurance. We’ve seen the managed money build up a near record-long position in the live cattle so it looks like the futures market may have run its course for the time being.

U.S. numbers fluctuate

Earlier in fall, the U.S. weekly slaughter was running about 30,000 head per week above year-ago levels. However, in mid-November, the weekly slaughter actually declined so that weekly beef production was last year for the first time since May. U.S. carcass weights are sharply below last year.

I’m projecting that U.S. beef production will decline into the first quarter of 2018. U.S. fourth-quarter beef production is expected to finish at 7.0 billion pounds but first-quarter 2018 production will drop to 6.4 billion pounds.

The market is moving from a burdensome supply situation to a tighter stocks environment. In Canada, the weekly slaughter has been running near 59,000 head per week but I’m also forecasting a marginal decline in weekly production in January and February.

Looking at the demand, the Conference Board measures U.S consumer confidence and the reading in October came in at a historical high of 125.9, up from 120.6 in September. This is a leading indicator of the economy because it predicts consumer spending over the next four to six months. Consumer spending is the largest factor influencing beef demand and also makes up about 70 per cent of U.S. GDP. Restaurant and retail beef demand tends to make seasonal high in December and then slightly cools in January and February. We may not see such a sharp drop in restaurant spending in January because of the robust economy.

Feed margins negative

Over the past month, feedlots have bid up the price of feeder cattle so that feeding margins are in negative territory. For feedlot operators, yearling steers weighing 850 pounds are selling for $205 and with a cost-per-pound gain of $1, the breakeven price for fed cattle in April is $162. At this time, the highest prices available for forward contracting have been around $160.

For backgrounding operators, steers weighing 525 pounds have been trading for $235 in central Alberta. Using $1.05 cost per pound gain, the breakeven price when the animal is 850 pounds is $1.86. For backgrounding, the market looks fairly valued. The yearling market is expected to hold value into the first quarter of 2018. Cattle buyers have seen two distinct markets in Western Canada in November because prices in eastern Saskatchewan and Manitoba have traded at a $10 premium over Alberta prices. This is largely due to buying interest from Ontario. In eastern Saskatchewan, mixed steers weighing 525 pounds reached up to $260 so this results in a breakeven price of $202 for an 850 pound steer in April. Margins are quite thin for these calves in the eastern Prairies.

Managed money

The funds have added to their net long position over the past month. At the end of October, the managed money had a net long of 121,000 contracts. We saw back in June that the long was near 130,000 contracts so their running out of buying power. Strength in the fed cattle has pulled up the feeders in the nearby and deferred positions. Therefore, backgrounding operators should look at taking price protection on about 30 to 50 per cent of their expected marketings for the January through June timeframe.

The fundamentals look favourable for fed cattle into the first quarter of 2018. Production is expected to decline and demand looks firm. For feeder cattle, the market is now at levels where there is minimal or no margin on yearlings and calves. At the same time, the futures market has experienced active fund buying. Now is the time to take some protection on first and second quarter feeder cattle marketings.