CME (Chicago Mercantile Exchange) December 2023 live cattle futures made a high of US$199.75 per hundredweight on Sept. 15.

The market held at the higher levels until the end of September and then started to trend low, bottoming around $166 on Dec. 7 (all figures US$). There were a few signals stating that the market was topping out in late September, but there was one red flag that stood out amongst all others.

The placement data on the U.S. Department of Agriculture’s Cattle on Feed report showed that market-ready supplies during September 2023 should be similar to those in September of 2022.

Read Also

India likely to triple lentil import duty

Analysts anticipate India hiking duties to 30 per cent after March 31 to bolster domestic prices on expectation of strong harvest.

However, by the end of September 2023, analysts realized the steer and heifer slaughter was going to be down sharply from September 2022. Packers had purposely restrained slaughter in September, resulting in a domino effect that would cause cattle to become backed up in feedlots.

I’m going to discuss the supply situation during September as an example. Cattle producers can use this information to monitor the supply and demand balance for market-ready supplies of steers and heifers. Depending on the balance, if supplies are larger than the slaughter pace, the market will likely trade lower, and vice versa.

USDA’s Cattle on Feed report shows the survey results of how many cattle are on feed as of the first of each month. The survey also shows the number of steers and heifers placed in feedlots, along with the number of fed cattle marketed by feedlots during the previous month. Only feedlots with capacity for more than 1,000 head are in the survey.

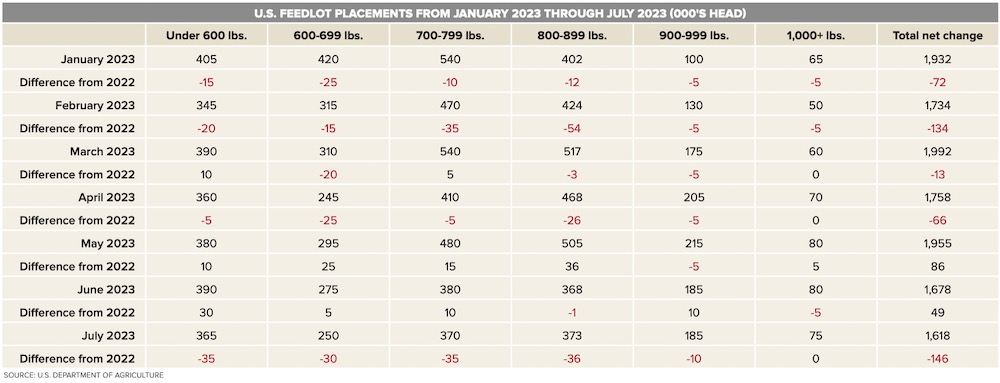

The important information is in the details. The Cattle on Feed survey shows how many steers and heifers are placed by weight category. The table you see below shows the U.S. feedlot placements of steers and heifers by weight category from January through July. It’s important to compare with the previous year as we have done below.

To project the market-ready supplies of fed cattle for September 2023, we start with the January 2023 placements under 600 lbs., which were 405,000 head.

Onto this number, we add the February placements in the 600- to 699-lb. category, which were 315,000 head, bringing the total to 720,000 head.

We then add onto this number the March placements in the 700- to 799-lb. category of 540,000 head and the April placements in the 800- to 899-lb. category of 468,000 head. The total so far is 1.728 million head, but we are not quite finished.

Onto this total we add the May placements in the 800- to 899-lb. category of 215,000 head and finally, we add the June placements in the 1,000-lb.-plus category of 80,000 head. Market-ready supplies of steers and heifers in feedlots with 1,000-head-plus capacity for September 2023 totalled 2.023 million head.

If we add the year-over-year change, the 2.023 million-head total is down 71,000 head from the previous year. Official data for September had the U.S. steer and heifer slaughter at 2.034 million head, down 227,400 head.

The most common way to calculate the steer and heifer surplus at the end of the month is to do the following calculation. Subtract the year-over-year change in market-ready supplies, which is negative 71,000 head, from the year-over-year decrease in the slaughter of 227,400 head. This equates to 156,400 head surplus. This gives us an indication of the steer and heifer surplus at the end of September.

The Cattle on Feed report confirmed this number, showing that U.S. feedlot marketings during September were down 11 per cent, or 197,000 head, from September 2022. There is always a margin of error, and we can account for U.S. imports from Canada.

However, one can see the processing pace during September was lower than the available supplies of steers and heifers. There were 156,400 head of market-ready fed cattle carried over from September into October.

Market-ready supplies of heifers and steers continued to grow through October and November. It’s important to be note that at the end of December 2023, there were an estimated 250,000 head of market-ready cattle backed up in U.S. feedlots. U.S. carcass weights for the week ending Jan. 5 were up 20 lbs. over year-ago levels.

The market will not strengthen with this burdensome supply situation. Eventually, feedlot operators have to sell the cattle. A similar supply situation has been building in Alberta and Saskatchewan.

In conclusion, it’s important that feedlot operators and cow-calf producers are aware of the supply and demand balance for fed cattle. Adding up the market-ready supplies for a specific month and comparing this to the weekly slaughter pace will help cattle producers with timing of forward sales and their hedging program. This is how we were taught to analyze fed cattle supplies.

If supplies exceed demand, the market will trend lower, and vice versa. The fed cattle market has an inelastic demand curve, which means a small change in supply has a large influence on the price.

In our example, the December live cattle futures dropped $30/cwt from last September through early December. This simple exercise can save cattle producers a fortune. This is how hedge funds and packers analyze the market. You now have the same tools to trade against the big players on the market.