Fed and feeder cattle prices continued to trend lower in August and early September as the market absorbs the year-over-year increase in beef production.

Alberta packers were buying fed cattle in the range of $133 to $136 in late summer; values we haven’t seen since January of 2014. Feedlot margins continue to erode and the industry has now experienced a solid 12 months of negative margins, sometimes exceeding over $300 per head.

Buying power for feeder cattle has deteriorated and demand has shifted due to lower incomes from the feedlot sector. During the first week of September in central Alberta, larger-frame medium-flesh Angus-based steers averaging just over 800 pounds were trading for $175. At the same time, 600-pound Charolais-based steer calves were struggling to hold above $205 in the same region. These markets have adjusted to the year-over-year increase in the 2015 U.S. calf crop. The U.S. July and August slaughter was 300,000 head above last year. On the flip side, consumer demand for beef appears to be improving, which should cause cattle prices to slowly strengthen during final quarter of 2016 and stay firm until March of 2017.

Read Also

Fall clean-up and bringing animals home at the Eppich ranch

Winter is approaching which meant emoving old fence rows and bringing livestock home before the cold and the snow at the Eppich family ranch.

No slow down in production

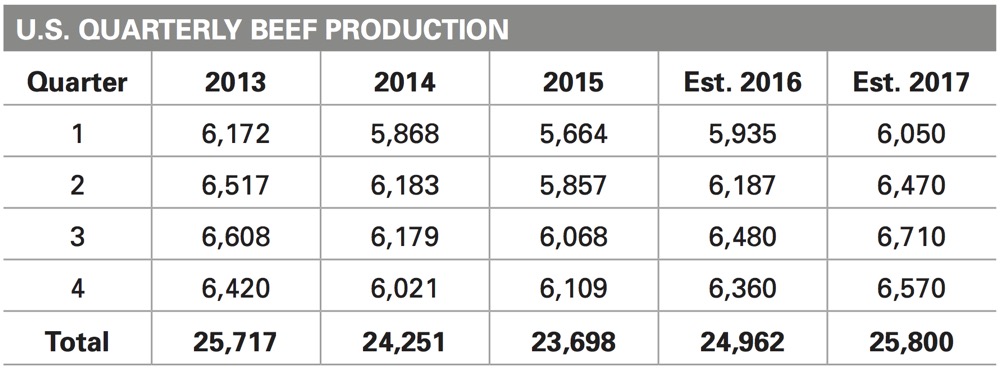

Each month, I include projections for quarterly U.S. beef and pork production. Once again, I want to draw attention to the 2016 third-quarter estimate of 6.48 billion pounds which is nearly 400 million pounds above last year. September will have the largest weekly average production levels and we’ll only see supplies decrease in mid-October. I often tell producers this is the most important piece if information when making your marketing plan or hedging program. In 2017, the lowest production occurs in the first quarter followed by sharp year-over-year increases in the second and third quarters.

U.S. consumers continue to increase food spending. Year-to-date at home food sales were up 4.1 per cent over year-ago levels during the summer; away-from-home food spending was running 7.8 per cent higher than last year. These positive numbers are largely due to the healthy labour market. Since the end of the recession, we’ve seen 2.1 million jobs added each year and this trend is expected to continue. The August U.S. unemployment rate came in at 4.9 per cent under the long-term average of 5.8 per cent. In addition to growing employment levels, wage growth has experienced a 2.3 per cent rise over the past year. Consumer behaviour suggests as income increases, the first thing they like to do is eat out. After this craving is satisfied, then they save up for additional material items or a fresh experience such as travel. Keep in mind most consumers gain three to five pounds on average during the holiday season of November and December.

Lowest market point ahead

The lows for the fed cattle market are expected to occur in September and first half of October. I’m expecting the fed market to percolate higher in November and December. In January, beef consumption usually decreases but then surges in March. The highest prices for fed cattle will likely occur in March. In April, weekly beef production on both sides of the border will slowly increase the market will function to encourage demand through lower prices during the summer and early fall of 2017.

Feeder cattle prices are expected to follow a similar pattern. I’ve advised many cow-calf producers to hold onto their calves through the winter. If you are holding yearlings, this may be the year you look to finish the cattle yourself or in a custom feedlot so that you will receive the most value. My dad always said you can work outside during the day but the money made on the operation is sharpening your pencil in the evenings doing your market analysis and developing your marketing or feeding plan. Feed barley was trading in Lethbridge at $158/mt in early September. Large supplies of barley and alternate feed grains will be burdensome throughout the crop year. This will result in lower costs per pound gain and be supportive for feeder cattle through the winter. There won’t be a “home run” strategy this year because U.S. beef production during 2017 could be 1 billion pounds above 2016.