Alberta packers were buying fed cattle on a live basis in the range of $163-$165 during the second week of December. This is up $9-$11 from 30 days earlier.

Canadian prices have been pulled higher by strength in the U.S. fed market. Fed cattle prices in Texas and Kansas were actively trading in the range of US$140-$142 (C$176-$180) on a live basis. The U.S. fed market has maintained a sharp premium over Alberta.

There appears to be a backlog of market-ready supplies in Western Canada, however we’ve recently seen an uptick in fed cattle exports given the wide price gap. The increase in fed cattle prices has caused the feeder market to experience a year-end bounce.

Read Also

Get ready for an eventual transition on cattle traceability

When new federal cattle traceability rules do ultimately take effect, reporting requirements will vary for producers, transporters, feedlots and markets — but most of the onus will be on producers.

In the main markets of central Alberta, mixed steers weighing 850 lbs. dipped down to the range of $170-$175 in late November. However, by the middle of December these cattle were averaging $185 with quality packages touching $190. Calves also jumped $8 to $12 in the latter half of December. This has been a demand-driven rally in the market.

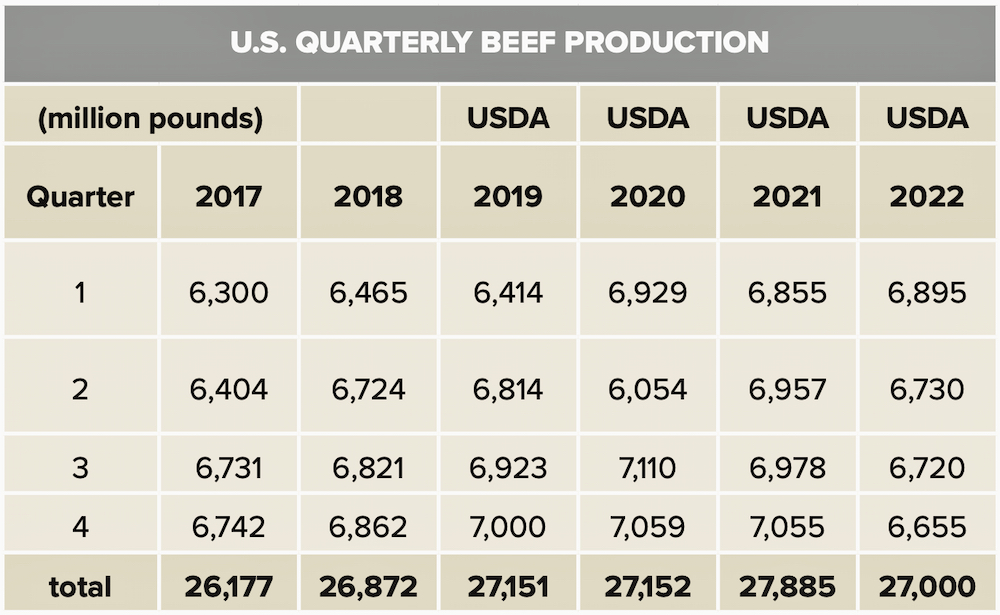

Looking forward, analysts are expecting a sharp year-over-year decline in quarterly beef production, which will keep prices well supported. Packing margins are expected to narrow as fed cattle prices percolate higher. The feeder market will function to encourage expansion through higher prices in the latter half of 2022.

Economic growth

U.S. economic growth surged during the fourth quarter of 2021. GDP is forecasted to finish in the range of six to eight per cent on an annual basis. Consumer spending is two-thirds of U.S. GDP and is highly correlated with beef demand. Wholesale beef prices during the second week of December had choice product at US$264/cwt while select product was trading at $252. Wholesale beef prices are up approximately US$50/cwt from year-ago levels.

Packing margins have been historically wide but will narrow moving forward for two reasons. It’s important to realize that gains in the spot wholesale beef market do not automatically result in higher packing margins. Beef and animal products are sold on longer-term contracts. Packers will become more aggressive to purchase fed cattle they renew these longer-term contracts with restaurants and retailers. Eventually, these gains will trickle down to the feeder market. We’ve started to see this in the fed cattle market during November and December with a US$12-$15 rally in Southern Plains fed cattle prices.

Numbers dropping

Cattle-on-feed inventories on both sides of the border are expected to drop below year-ago levels during 2022. The cow slaughter is running at historically high levels. We’re bound to see a year-over-year decline in feedlot placements. According to the USDA projections, U.S. second-quarter beef production will be down 227 million pounds from the second quarter of 2021; third-quarter production will decline year over year by 258 million pounds. The big drop comes in the fourth quarter when beef production is expected to be down 400 million pounds from the fourth quarter of 2021.

Canadian and U.S. fed cattle prices have the potential to reach historical highs in the October through December 2021 time frame. During the summer of 2022, the October and December live cattle futures market will start to incorporate a risk premium due to the uncertainty in beef production. Packing margins have been favourable this past year but these margins will get squeezed during the winter of 2022/23. Trust me on this one.

We’re seeing a La Nina development in the Pacific Ocean. This usually results in a cooler and wetter summer across the Canadian Prairies. Early estimates suggest barley production will reach 11.5 million tonnes, up from the 2021 output of only 6.9 million tonnes. We’re going to see lower feed grain prices in 2022, there is no doubt about it. This will support the feeder market during the summer. I’m expecting grass cattle to reach fresh 52-week highs next spring because the yearling market in the fall of 2022 will be “red hot.”

As we start 2022, wholesale beef prices are sharply higher than a year ago due to strong consumer spending. Packing margins are high but will narrow moving forward as fed cattle prices percolate higher. Fed cattle prices are expected to reach historical highs during the final quarter of 2022. Barley production is expected to rebound and feed grain prices will decline. Feeder cattle prices will start to trend higher in late spring and summer as the market adjusts to the new fundamentals.