The coronavirus epidemic has contributed to the drop in fed cattle prices over the past couple of months.

In the last week of January, Alberta packers were buying fed cattle at $275 on a dressed basis and $165 on a live basis but as of the first week of March, Alberta packer bids were in the range of $245 to $247 dressed and $147 live. Finishing feedlots enjoyed a brief period of positive margins early in the year but losses are now in excess of $200 per head on unhedged cattle.

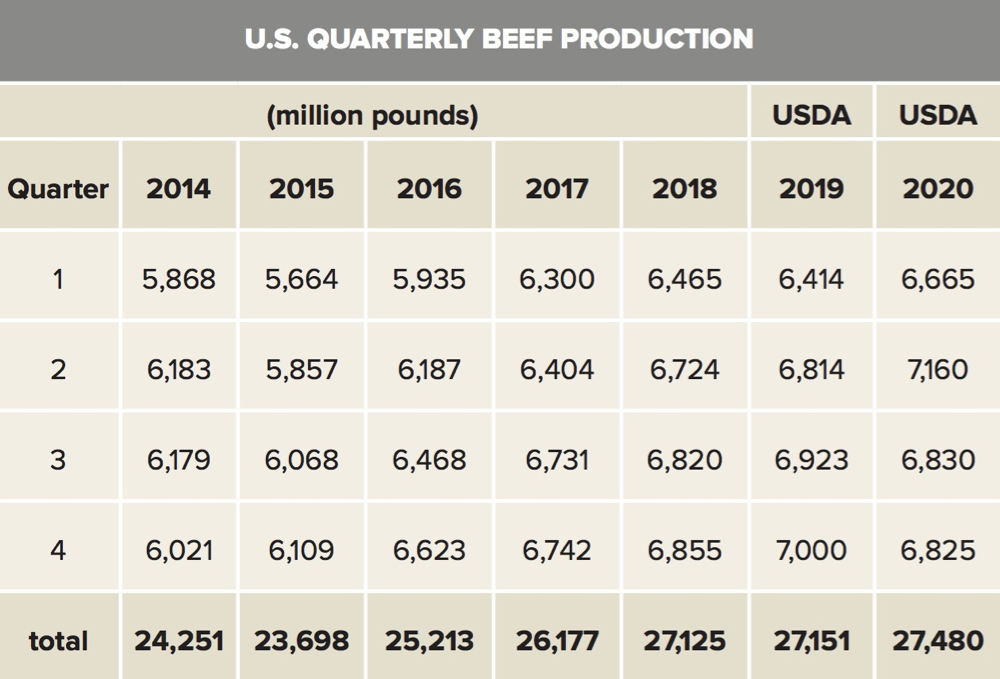

This slide in the fed cattle market has been unprecedented. The uncertainty in beef demand comes on the heels of growing supplies. U.S. second-quarter beef production will reach historical highs. The combination of lower demand and larger than expected production is setting a negative tone. Yearling prices have mirrored the drop in the fed cattle market as the August live cattle futures trade near contract lows. In late January, mixed steers averaging 850 pounds were readily selling around $190 in central Alberta. During the first week of March, similar weight and quality steers were valued at $173 to $175. Calves and grass cattle have experienced marginal weakness dropping $5 to $8 from late January. It’s important that cattle producers have a good understanding of the fundamentals as analysts try to assess the changing market environment.

Read Also

Fall clean-up and bringing animals home at the Eppich ranch

Winter is approaching which meant emoving old fence rows and bringing livestock home before the cold and the snow at the Eppich family ranch.

Earlier in winter, U.S. first-quarter beef production was expected to come in near 6.4 billion pounds. However, the larger than expected slaughter along with a year-over-year increase in carcass weights caused production estimates to increase to 6.6 to 6.7 billion pounds. In late January, it became evident that the supply situation was growing and not tightening. On the quarterly beef production table, second-quarter beef production is expected to reach up to 7.2 billion pounds. The market is absorbing a quarter-over-quarter increase of nearly 500 million pounds. Carcass weights are not experiencing the seasonal decline from January through June. It also looks like the feedlot placements during July through September 2019 may have been understated.

From August through December 2019, Alberta and Saskatchewan feedlot placements were 1.2 million head, up 150,000 head from last year. This will translate into higher market-ready supplies from May through July 2020. For example, market-ready supplies during May 2020 are expected to be up 20,000 to 30,000 head from last year. During June 2020, market-ready supplies of fed cattle have potential to be up 90,000 to 100,000 head from a year ago. Western Canada also has a very bearish scenario for the second quarter due to the burdensome supply.

The U.S. Federal Reserve and the Bank of Canada lowered their benchmark lending rate by half a percentage point during the first week of March. This was considered a pre-emptive strike against slower economic growth in the second quarter. Consumer spending comprises approximately two-thirds of U.S. GDP and lower interest rates should encourage consumers and businesses to borrow and spend.

A one per cent increase in consumer spending equates to a one per cent increase in beef demand, and vice versa. In a normal year, beef demand makes a seasonal high during March resulting in stronger fed cattle prices. However, for March and April of 2020, consumer spending is expected to drop by eight to 10 per cent from 2020, which will cause beef demand to decline from last year.

The height of the coronavirus epidemic will likely occur in April and then demand will start to improve during May. By July beef demand is expected to be up four to five per cent from year-ago levels. Travel, hospitality and restaurants will bear the brunt of the economic slowdown. First- and second-quarter beef export projections have also been trimmed due to lower import demand from China and Southeast Asia. There are larger supplies available for the domestic market.

The prolonged period of negative margins in the feedlot sector will continue to overhang the feeder market. On the flip side, the U.S. semi-annual cattle inventory reports had the 2019 calf crop down 250,000 head from 2018 and Statistics Canada reported that the 2019 calf crop was down about 46,000 head from 2018. There will be tighter supplies of yearlings and calves this fall. Cow-calf producers need to watch the December 2020 and April 2021 live cattle futures moving forward as this will dictate the price direction for the feeder market. By late August and September, the coronavirus epidemic will likely be history and we’ll see yearling prices trade at similar levels to last year.