MNP has developed a risk management tool that helps farmers select the right amounts and types of insurance to protect profit margins and minimize losses. MNP calls its new tool the Ag Risk Management Projector (ARMP) and the cost starts at around $1,200.

The ARMP is an interactive tool to help farmers make better insurance decisions and understand the impact of those decisions on their bottom line. It will allow you to calculate projected margins and different types of insurance coverage available under a variety of possible scenarios and is primarily geared towards western Canadian crop farmers.

Read Also

Agriculture and its contribution to circular economy

The circular economy has garnered much interest recently. The approach that challenges how organizations address resource efficiency is gaining traction…

Canadian farmers have a number of risk management options available, from Crop Insurance and AgriStability, to other private sector programs. The challenge most farmers have is to understand clearly what each program might cover and how that coverage works with other insurance you’ve invested in.

I spoke to Steve Funk who is the Director of Farm Income Programs at MNP to explain how ARMP works.

The nuts and bolts of the ARMP

“We can plug in crop production variables for the upcoming season such as which crops they are seeding, expected prices and yields for each crop, input costs, expenses and risk management input from insurance quotes, and AgriStability benefit notices into the ARMP system,” says Funk. “All information shared is confidential.” When needed, they can use comparative data from historical financial statements for things such as wages, fuel, rent, depreciation on equipment and so on if they need to fill in costs that you might not know offhand.

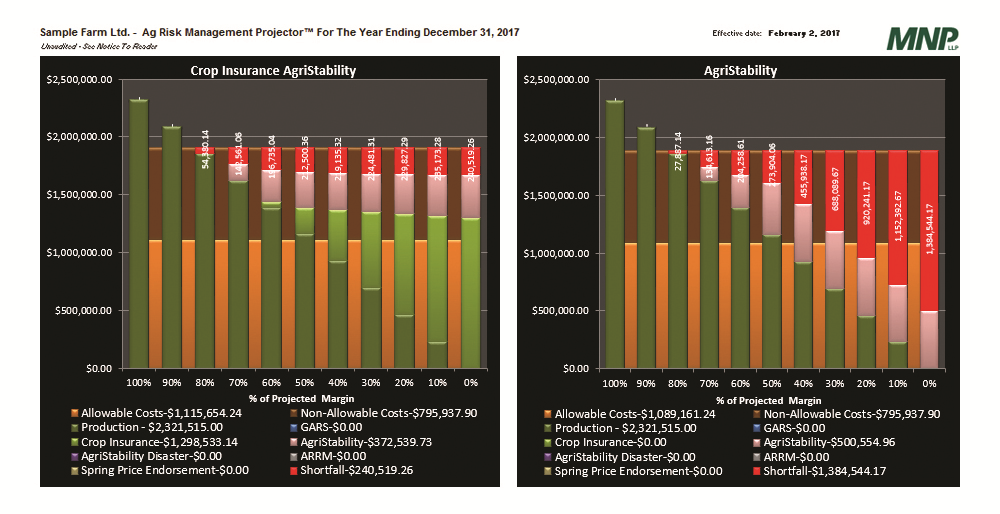

The output from the ARMP is a series of side-by-side graphs. Those graphs show estimated revenue for all crops if everything goes as planned, as well as 10 other possible scenarios with lost revenue in 10 per cent increments down to a complete crop loss. The ARMP graphs also factor in the costs for inputs and expenses, as well as the costs for the various insurance programs under consideration to demonstrate what you’re paying for and the impact it could have on your profit margin. “We’re trying to model a complete income statement on an accrual basis,” says Funk.

The graphs can be in absolute dollars or dollars per acre, which allow farmers to view numbers that they can best relate to. Funk is cautious when using the cost per-acre model as he feels it doesn’t always provide the clearest picture of total losses. “A $10/ac. loss doesn’t seem as bad as a total loss of over $50,000,” says Funk.

Below the main graphs are overall financial analysis, cost analysis of the insurance programs as well as a number of toggle boxes for various types and levels of insurance coverage and sensitivity analysis on revenues and costs. Choosing various combinations in the toggle boxes and observing the results on the graphs provide meaningful aid in decision-making.

Funk says the real value of the analysis is showing producers the erosion of their profit margin as yields or market prices decrease – and what kinds of insurance programs and coverage are needed to offset those losses. “As programs are added, the cost of that program and what it covers for the specific scenario are added and updated immediately,” says Funk.

“A lot of times we’re getting people wanting to focus their decision on one product at a time. And we have known for a while that is probably not the right approach,” says Funk.

“One program is not the silver bullet. It’s not going to provide the coverage for the perils they may face. It’s usually two and sometimes three that are needed to adequately protect producers.”

While many factors can be taken into account in the system, it isn’t possible to model everything. But the ARMP can show a variety of scenarios to producers and enable them to make the best decisions possible on insurance coverage.

Funk says he finds many Canadian farmers are either under- or over insured. Another benefit of the ARMP is it helps producers visualize their specific scenario so they can see where they may need to re-evaluate the existing coverage they have.

Start the new year right

With deadlines for all types of crop and other insurance plans looming, Funk says today is a good day to start collecting the information needed to work with a consultant on reviewing insurance coverage. “We’re starting to have these conversations now with producers because planning for the next season and seeding is just around the corner,” says Funk.

From the initial conversation with producers, MNP advisers are usually able to provide the final models within about a week’s time. Funk says this is not a do-it-yourself system and the representatives working withproducers on ARMP have had special training to be able to ensure the best information is shared. This will help producers make better decisions.

As I mentioned earlier, the cost to use the ARMP starts at about $1,200. That may seem like a lot but Funk says farmers should put that into perspective when many are spending thousands of dollars on various kinds of insurance on their farm. Funk says you have to decide if it’s worth it to make sure the insurance premiums you’re paying are doing the most good and providing your farm with the best risk management options. Annemarie Pedersen is a freelance writer from Calgary.