By Glen Hallick, MarketsFarm

Glacier Farm Media MarketsFarm – Intercontinental Exchange canola futures finished the week out on a strong note Friday, after recovering most of the previous day’s losses.

A trader said heightened tensions in the Middle East resulted in sharp upticks in global crude oil prices, affecting the commodities and the futures.

There were increases in European rapeseed along with Chicago soybeans and soymeal. However, soyoil couldn’t catch a break and posted small declines. Malaysian palm traded for the first time in two days, also closing lower.

Read Also

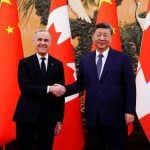

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

The Canadian Grain Commission reported, producer deliveries of canola after 36 weeks into the 2023/24 marketing year, reached 12.22 million tonnes. However, that’s behind last year’s pace of 13.73 million tonnes. Canola exports continued to lag at 4.24 million tonnes versus 6.25 million a year ago. Domestic usage remained ahead of pace at 7.60 million tonnes versus 7.13 million.

The Canadian dollar was weaker at mid-afternoon Friday as the loonie skidded to 72.56 U.S. cents compared to Thursday’s close of 73.04.

There were 74,823 contracts traded on Friday, compared to Thursday when 70,115 contracts changed hands. Spreading accounted for 50,118 contracts traded.

Prices are in Canadian dollars per metric tonne:

Price Change Canola May 634.70 up 10.40 Jul 646.30 up 10.60 Nov 657.00 up 11.70 Jan 663.60 up 11.70

SOYBEAN futures at the Chicago Board of Trade were stronger on Friday, however soyoil continued to struggle.

The possibility of Iran striking Israel or the United States, in retaliation for a recent Israeli attack on the Iranian embassy in Syria, had the markets concerned. By mid-afternoon sharp spikes in crude oil prices faded into modest gains.

The U.S. Department of Agriculture announced a private sale for 124,000 tonnes of old crop soybeans to unknown destinations.

There’s disagreement in the trade over the accuracy of supply and demand reports from the USDA and Conab, its Brazilian equivalent. While the USDA’s estimate, based on satellite imagery, has Brazil reaping 155 million tonnes soybeans, Conab’s call, based on farmer surveys, came in at 146.5 million.

Meanwhile, consultancy Safras & Mercado raised its projection by 2.65 million tonnes to now 151.25 million.

The Buenos Aires Grain Exchange cut its call on Argentina soybean production by 1.5 million tonnes at 51 million. The BAGE also estimated the harvest at 10.6 per cent complete.

China reported its March soybean imports of 5.54 million tonnes fell 20 per cent from a year ago.

CORN futures were higher on Friday, in sympathy with other gains in the commodities.

The USDA/Conab situation has also involved Brazil corn. The USDA forecast a harvest of 124 million tonnes, while Conab said the country is to glean about 111 million tonnes.

Safras & Mercado placed its Brazil corn estimate at 125.86 million tonnes, down 27,000 from its previous projection.

The BAGE chopped its forecast on Argentina corn output by 2.5 million tonnes at 49.5 million, pointing to disease along with hot and dry conditions.

Russia said it will reduce its corn export tax to zero per cent from Apr. 17 to 23. It’s currently at 86 roubles per tonne.

WHEAT futures were higher on Friday, as part of the general upward trend.

As rain slowed field work in the eastern half of the U.S. Midwest, warmer and drier conditions in the western half and in the Northern Plains saw planting carry on. However, dryness in parts of the Central Plains could threaten winter wheat crops.

France said its soft wheat crop was 64 per cent good to excellent, down one point from last week and the lowest rating in four years.

Russia said it will raise its wheat export tax by 40.5 roubles/tonne from Apr. 17-23.

Total grain exports from Ukraine for 2023/24 reached 37.6 million tonnes, down from the previous year’s 39.2 million.