By Glen Hallick, MarketsFarm

Glacier Farm Media MarketsFarm – Intercontinental Exchange canola futures closed steady to higher on Tuesday, as most contracts barely hung on to their gains.

Support for the Canadian oilseed came from upticks in European rapeseed and Malaysian palm oil. However, pressure from losses in the Chicago soy complex almost proved to be too much for canola.

Concerns about dry conditions across the Prairies could be alleviated next week with precipitation in the forecast.

The May contract finished slightly below its 100-day moving average after hovering near it for most of the session.

Read Also

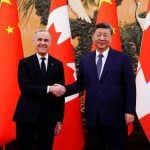

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

The United States Department of Agriculture attaché in Vienna placed European Union rapeseed production for 2024/25 at 18.80 million tonnes, down 4.4 per cent from last year. The USDA attaché in Brisbane projected Australian canola output to rise to 6.50 million tonnes.

The Canadian dollar is virtually unchanged at mid-afternoon Tuesday, with the loonie at 73.62 U.S. cents.

There were 50,655 contracts traded on Tuesday, compared to Monday when 45,740 contracts changed hands. Spreading accounted for 33,444 contracts traded.

Prices are in Canadian dollars per metric tonne:

Price Change Canola May 639.30 up 1.00 Jul 648.10 unchanged Nov 657.40 up 1.00 Jan 664.30 up 0.70

SOYBEAN futures at the Chicago Board of Trade were lower on Tuesday, due to the United States weather forecast.

While western side of the U.S. Midwest is forecast to remain dry, the eastern half is to get rain this week. The Northern Plains are expected to receive rain in the 11 to 15-day forecast.

The U.S. Department of Agriculture reported a private sale of 124,000 tonnes of old crop soybeans to unknown destinations.

The USDA is set to publish its April supply and demand estimates on Thursday. U.S. soybean ending stocks for 2023/24 are expected to increase to 317.0 million bushels. The world carryover is projected to slip to 113.7 million tonnes.

Sizable soybean harvests in Brazil and Argentina continued to weigh on North American values.

Dr. Michael Cordonnier of Soybean and Corn Advisor kept his calls for soybean output in Brazil and Argentina at 145.0 million and 51.0 million tonnes respectively.

Consultancy AgResource upped its projection on Brazil soybeans from 143.9 million tonnes to 145.5 million.

CORN futures were lower on Tuesday, joining soybeans to the downside.

The USDA issued its crop progress report with three per cent of the country’s corn being planted as of Apr. 7. Texas, at 59 per cent, was ahead by a very large margin compared to the other reporting states.

Going into Thursday’s S&D report, U.S. corn ending stocks were forecast to slip to 2.1 billion bushels. The global carryover was projected to drop to 316.7 million tonnes.

Large corn harvests in Brazil and Argentina continued to weigh on North American pricing.

Cordonnier kept his projection on the Brazil corn harvest at 112.0 million tonnes but lowered that for Argentina by two million tonnes at 53.0 million.

WHEAT futures were mostly lower on Tuesday, also due to the weather forecast.

The U.S. winter wheat crop remained at 56 per cent good to excellent. Six per cent of the crop has headed out, which is virtually on par with the five-year average.

U.S. spring wheat planted bumped up to three per cent nationally with Idaho and Washington far ahead at 25 and 21 per cent in the ground respectively.

Some of the worst spring flooding in parts of Russia and Kazakhstan in 70 years has seen the evacuation of more than 100,000 people. Meanwhile, other parts of Russia are reported to be in or near drought.

Japan issued a tender for nearly 121,500 tonnes of wheat to come from the U.S., Canada and Australia.