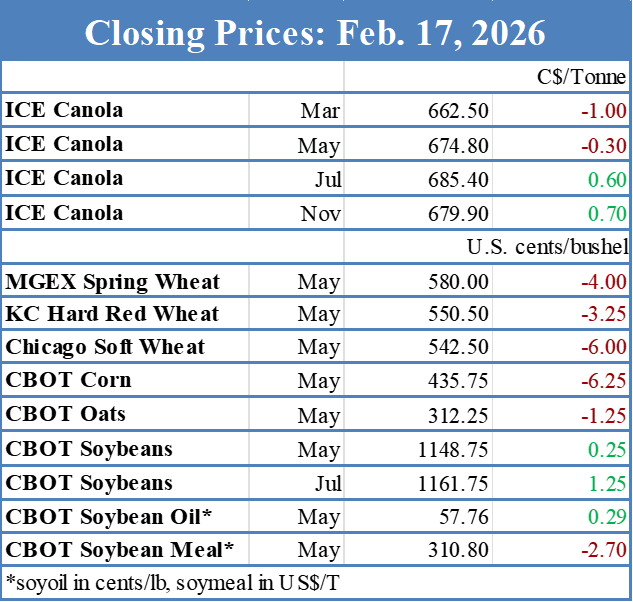

Glacier FarmMedia — The ICE Futures canola market settled narrowly mixed on Tuesday after trading to both sides of unchanged in choppy activity.

- Gains in Chicago soyoil and soybeans provided spillover support, with solid monthly crush data behind some of the strength in that market.

- However, European rapeseed was lower on the day, while many Asian markets were closed for the Lunar New Year holiday.

- The May contract ran into upside resistance, briefly trading above the psychological C$680 per tonne level before backing away to end roughly five dollars off its session highs.

- Large South American soybean supplies continued to temper any gains in the North American oilseed futures amid the advancing Brazilian harvest.

- There were 87,301 contracts traded on Tuesday, which compares with Friday when 82,956 contracts changed hands. Spreading was a feature, accounting for 69,806 of the contracts traded.

Read Also

CBOT soybeans up with solid crush data

SOYBEAN futures at the Chicago Board of Trade were stronger on Tuesday, underpinned by solid monthly crush data as trade…

Access the latest futures prices at https://www.producer.com/markets-futures-prices/

Stay informed with our daily market videos. Each video quickly covers key futures moves, price trends and market signals that matter to Canadian farmers. Get clear, timely insights in just a few minutes. Bookmark https://www.producer.com/markets-futures-prices/videos