By Glen Hallick

Glacier Farm Media MarketsFarm – Intercontinental Exchange canola futures were mostly lower by mid-session Wednesday.

Pressure on canola was coming from losses in the Chicago soy complex, with soyoil down by more than four-tenths of a cent per pound. Support was derived from gains in European rapeseed while the markets in Malaysia were closed for a holiday. Global crude oil prices were relatively steady, which provided little direction to the oilseeds.

An analyst noted the 20-day and 100-day moving averages for canola’s May contract were converging. The 20-day stood at C$635.40 per tonne and the 100-day was at C$640.15.

Read Also

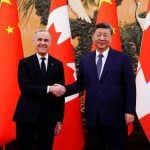

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

“There’s a real pinch at work here,” the analyst commented, suggesting canola is about to break out its sideways trading pattern one way or the other.

The Canadian dollar fell back late Wednesday morning as the United States dollar surged upward. That saw the loonie drop to 73.02 U.S. cents compared to Tuesday’s close of 73.65.

Approximately 23,250 canola contracts were traded as of 10:21 CDT, with prices in Canadian dollars per metric tonne:

Price Change Canola May 637.00 dn 2.30 Jul 646.80 dn 1.30 Nov 656.90 dn 0.50 Jan 663.20 dn 1.10