By Phil Franz-Warkentin

Glacier FarmMedia MarketsFarm – The ICE Futures canola market was weaker at midday Tuesday, seeing a continuation of Monday’s selloff as losses in outside markets weighed on values.

Chicago soyoil, European rapeseed and Malaysian palm oil futures were all lower, although crude oil was slightly firmer at midday.

Poor export demand continues to overhang the canola market, according to a trader who noted that the export pace is running about 2.2 million tonnes behind the previous year’s pace. The widening old/new crop spread was another bearish indicator according to the trader, with end users showing little concern over sourcing old crop supplies ahead of the harvest. While July canola has often traded at a premium to the new crop November futures at this time of year, it was trading at a discount of about C$16 per tonne on Tuesday.

Read Also

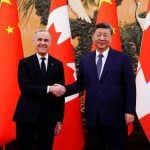

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

Forecasts calling for welcome precipitation across dry areas of Western Canada over the next week contributed to the declines.

The Canadian dollar was weaker relative to its United States counterpart at midday, providing some underlying support.

An estimated 39,200 canola contracts traded as of 11:02 CDT.

Prices in Canadian dollars per metric tonne at 11:02 CDT:

Canola May 615.10 dn 4.80

Jul 626.80 dn 4.60

Nov 642.90 dn 2.90

Jan 651.30 dn 2.10