A Manhattan private equity firm deep in “middle-market infrastructure” has committed to buy, and help improve service from, Canada’s single biggest rural broadband provider.

New Brunswick-based, privately held Xplornet Communications announced Thursday it has signed a deal to sell majority control itself to Stonepeak Infrastructure Partners.

The two companies’ announcement didn’t put a dollar figure to the deal, but a report Monday from Bloomberg, well ahead of Thursday’s announcement, quoted unnamed sources putting the price tag at about US$2 billion including debt.

Read Also

Canada must resist EU non-tariff trade barriers says Grains Council

Canada should lead like-minded countries to protect agricultural markets from non-tariff barriers based in politics rather than science, the Canadian Grains Council said in a new report.

The deal still requires regulatory approval and is expected to close “in the coming months,” Xplornet said in a release.

The funding from Stonepeak, whose portfolio today is valued around US$17.9 billion, is expected to give the company “a strong balance sheet to execute its plan of improving broadband service for residences and business in rural Canada, along with access to growth capital,” Xplornet said.

Xplornet CEO Allison Lenehan said the new investment “will position Xplornet to accelerate development of our facilities-based broadband network and services, enabling much faster speeds, including unlimited data plans at affordable prices for rural Canada.”

The New Brunswick company has been on an aggressive growth track in recent years, buying providers such as Saskatchewan’s YourLink and Manitoba’s NetSet in 2017. It also announced a deal earlier this month to buy southwestern Ontario-based Silo Wireless.

Xplornet also picked up a substantial customer base in rural Manitoba in 2017 when federal regulators ordered Bell Canada to divest assets for approval of its takeover of Manitoba telecom firm MTS.

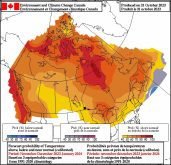

The company on Thursday reiterated its recently announced five-year plan to put up $500 million for hybrid fibre wireless and satellite technology for more broadband coverage over rural areas.

The deal announced Thursday calls for Lenehan to continue as Xplornet’s CEO and for the business to remain headquartered in New Brunswick.

Current board chairman Steve Weed and his Seattle-based investment fund WaveDivision Capital will also still be “material investors” in the Xplornet business, the companies noted.

Stonepeak, which bills itself as an investor in “long-lived, hard-asset” infrastructure including fuel and water pipelines and utilities, is no stranger to the internet service sector.

The investment firm’s assets also include Cologix, which operates data centres in the U.S. and Canada supporting web network interconnections, including 17 in Montreal, Vancouver and Toronto; wireless provider Extenet Systems; and wireless tower operator Vertical Bridge. — Glacier FarmMedia Network