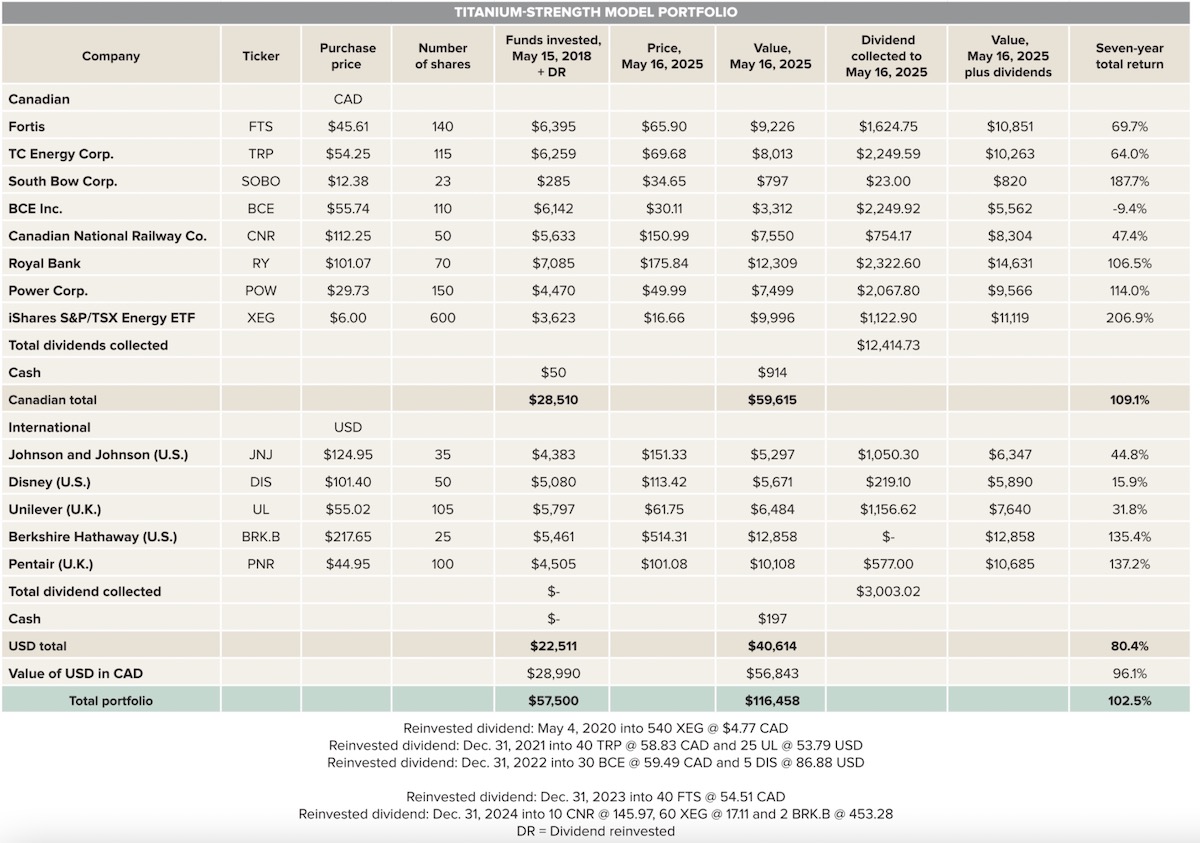

Seven years ago, I launched the Titanium Strength Portfolio to demonstrate how excellent returns can be achieved with minimal effort. Much has happened over those seven years, and if you had told me all the extenuating circumstances of this period, I might have been hesitant predicting what I did at the time: I wrote, “If you fell asleep for 10 years and woke up just once a year to reinvest the dividends, but otherwise didn’t touch the portfolio, you will be almost guaranteed to double your money. More likely you will have tripled it.”

It has doubled in seven years, which, using the Rule of 72, equates to a 10.3 per cent compound annual growth rate. The dividend reinvestment decisions are all listed in the table shown here. The only new positions added were the iShares S&P/TSX Capped Energy Index ETF (TSX: XEG) at the bottom of the COVID crash, and South Bow Corp. (TSX: SOBO) which was a TRP spinoff. Otherwise, dividends went to adding to existing positions.

Read Also

Avoid these thought traps when investing

Investing for Fun and Profit: Let’s review a list, by renowned fund manager Peter Lynch, of the most dangerous things that stock market investors can say to themselves, or to others.

Over those seven years, the S&P 500 experienced four declines of 20 per cent or more, which defines a bear market. The 2018 decline was blamed on Trump tariffs and trade war No. 1. The COVID crash followed in 2020, then in 2022 we had a dramatic spike in interest rates coupled with an end of the 2021 speculative fervour, and in 2025 we have once again experienced a rapid decline and recovery due to Trump tariffs and trade war No. 2, although we still don’t know if the current one is truly over. Bear markets normally occur about once every four to five years, and having four in a seven-year period is highly unusual — although these all tended to be modest bears with quick recoveries.

The Canadian market mirrored the U.S., but didn’t quite hit the 20 per cent drawdown level, except during the COVID crash. Its overall market performance has been weaker but more stable.

What we’ve learned

- “Activity is the enemy of investment returns,” Warren Buffett is said to have said. This axiom naturally depends on good stock selection to begin with.

- An investor cannot — I repeat, cannot — pick the tops and the bottoms of these market drawdowns. One key to success is understanding and accepting they are going to happen but not reacting when they do, other than to look for bargains. This point also depends on good stock selection to begin with.

- An investor does not need to chase hot stocks to get good returns. If Nvidia or Apple were in the portfolio, it would have done better; however, the purpose of the portfolio was to demonstrate excellent returns with minimal effort, rather than to maximize returns.

- You can’t predict at the outset which stock will perform the best. If you could, you would invest in just that stock. The normal distribution curve (the bell curve) will always come into play.

- You can’t predict which stock will be the worst performer. A while back I wrote about my concern with declining profitability in the telecom sector. However, I would have never predicted seven years ago that Bell would slash its dividend in half, which it recently did. That said, having 12 out of 13 positions in the green is admirable.

I hope following this portfolio for seven years has helped with your investment decisions.

On another note, further to “The economic trouble with Canada” (Grainews, May 6, page 18): the Fraser Institute just published an analysis of Canadian public-sector expenditures and debt, compared to other developed countries, and once again our performance is abysmal. Over the past decade public sector expenditures, both federal and provincial, have grown from 38.4 to 44.7 per cent of gross domestic product (GDP), the second-worst performance of 40 countries. Our total debt has grown from 85.5 to 110.8 per cent of GDP, the third-most growth of the 40 countries. Recent provincial budget announcements will only exacerbate this performance, and the federal government has pledged to expand expenditures but won’t yet release a budget. Why we continue to elect profligate governments is beyond my comprehension. Burdening future generations will not fix today’s problems.

On top of declining business investment, declining per-capita GDP and rapidly increasing public-sector employment compared to private-sector, we now have the fourth splintered leg of our wobbly economic chair, being debt and deficits. These all occurred prior to current trade disputes, which will also be impactful.