By Phil Franz-Warkentin

Glacier FarmMedia MarketsFarm – The ICE Futures canola market traded to both sides of unchanged on Wednesday, settling narrowly mixed.

After losing over C$20 per tonne in the span of two days, values were looking oversold and in need of correction. Strength in the Chicago soy market was also supportive.

However, a lack of significant export demand remained a bearish influence in the background, with the export pace lagging well behind what moved at the same time a year ago. Beneficial moisture in parts of Western Canada also weighed on prices.

Read Also

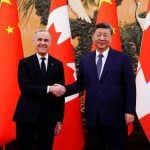

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

European rapeseed and Malaysian palm oil futures were both lower on the day, which also pressured the Canadian oilseed.

There were an estimated 66,616 contracts traded on Wednesday, which compares with Tuesday when 80,856 contracts traded. Spreading accounted for 43,760 of the contracts traded.

CBOT soybeans correct higher, grains down

SOYBEAN futures at the Chicago Board of Trade managed to post small gains on Wednesday, finding some support after dropping below some key moving averages earlier in the week.

The gains came despite mounting competition from South America. Recent strength in the United States dollar relative to its Brazilian counterpart has reduced the competitiveness of U.S. exports compared to soybeans and corn out of Brazil, with farmers in Brazil reportedly increasing their sales as harvest activity wraps up in the country.

Brazilian soybean exports are now forecast to hit 13.7 million tonnes in April according to the country’s association of exporters (ANEC). If realized, that would be up by a million tonnes from an estimate out just last week.

Meanwhile, rains are expected to cause some seeding delays across the U.S. over the next week, although the moisture will be beneficial for crops in the long run.

Uncertainty in the global energy markets, as participants continue to watch for any developments on the situation between Israel and Iran, kept some caution in the agricultural futures.

CORN was down, taking some direction from the losses in wheat.

U.S. ethanol production dipped below a million barrels per day in the latest weekly report from the Energy Information Administration (EIA), coming in at 983,000 bpd. That marked the lowest level in three months. Supplies of the renewable fuel came in at 26.08 million barrels, down slightly from the previous week, but above average trade estimates.

Corn traders also continue to follow the Midwestern weather news closely.

WHEAT was down across the board, with the forecasts calling for rain in some dry areas of the U.S. Plains behind some of the selling pressure.

Export competition out of Russia also continued to weigh on the wheat market.