By Phil Franz-Warkentin

Glacier FarmMedia MarketsFarm – The ICE Futures canola market traded to both sides of unchanged on Friday, holding onto small gains at the final bell.

Advances in the Chicago soy complex provided spillover support for the Canadian oilseed. Chart-based positioning was a feature, with the most-active July contract settling just below its 50-day moving average.

However, soft export demand remained a bearish influence overhanging the canola market. Canadian canola exports continue to run well behind the year ago pace. Canola exports during the past week of 128,300 tonnes brought the 2023/24 year-to-date total to 4.37 million tonnes. That compares with 6.42 million tonnes at the same point the previous crop year.

Read Also

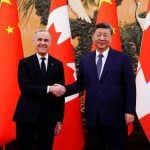

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

Losses in European rapeseed and Malaysian palm oil futures also tempered the upside in canola.

There were an estimated 44,915 contracts traded on Friday, which compares with Thursday when 64,637 contracts traded. Spreading accounted for 29,364 of the contracts traded.

SOYBEAN futures at the Chicago Board of Trade were stronger on Friday, with speculative short-covering ahead of the weekend behind some of the activity. Ongoing concerns over unrest in the Middle East also kept some caution in the grains and oilseeds.

Soybeans traded just above contract lows on Thursday, with oversold price sentiment helping values see a chart-based correction.

The United States Department of Agriculture announced private export sales of 121,500 tonnes of soybeans to unknown destinations, with the majority to move in the new crop year.

However, U.S. soybeans remained pressured by cheaper beans from Brazil, as the harvest wraps up there and a weaker Brazilian currency encourages increased farmer deliveries.

CORN was higher, taking some direction from soybeans and wheat.

The USDA announced flash sales of 216,500 tonnes of corn to Mexico this morning.

Corn traders also continued to follow the Midwestern weather news closely. Rains across parts of the Midwest will likely cause some seeding delays but will be beneficial for the crops in the long run.

WHEAT was higher across the board, as persistent dryness concerns in parts of the Southern Plains remained supportive.

Forecasts calling for overnight lows near freezing also underpinned the futures. However, crop damage is unlikely, and there was also some beneficial moisture in the outlooks.

Export competition out of Russia also continued to limit the upside potential in wheat.