Glacier FarmMedia MarketsFarm — The ICE Futures canola market took another step back on Thursday to go along with mixed activity in comparable oils.

Malaysian palm oil was down with European rapeseed mostly lower, while Chicago soyoil was higher. There were increases in crude oil as a draw in domestic inventories offset a slowdown in the United States economy.

At mid-afternoon, the Canadian dollar was up one-quarter of a U.S. cent compared to Wednesday’s close.

There were 52,182 canola contracts traded on Thursday, which compares with Wednesday when 46,880 contracts changed hands. Spreading accounted for 30,332 of the contracts traded.

Read Also

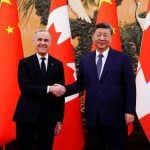

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

July WHEAT prices extended their rallies on Thursday, as double-digit gains were made by Kansas City hard red wheat on the Chicago Board of Trade (CBOT) as well as Minneapolis spring wheat. July Minneapolis spring wheat came one-quarter of a cent per bushel shy of reaching US$7 per bushel during trading for the first time since early February.

The United States Department of Agriculture reported 82,000 tonnes of old crop U.S. wheat export sales for the week ended April 18, mostly to China. However, almost 372,000 tonnes of new crop U.S. wheat were also sold during the same week.

The eastern half of hard red wheat growing areas of the U.S. will see six to 38 millimetres of rain over the next five days, while Oklahoma, parts of western Kansas and the Texas Panhandle will be left dry.

The USDA’s attache in Ottawa estimated 33.67 million tonnes of wheat production in Canada for 2024-25, up 1.7 million tonnes from the previous year.

Algeria purchased 200,000 tonnes of durum wheat in a tender earlier today.

July CORN recovered some of losses on Wednesday’s losses after its three-day rally ended on that day.

Nearly 1.3 million tonnes of old crop U.S. corn were sold for export, almost 50 per cent above the higher end of trade expectations. In addition, 262,300 tonnes of new crop corn were also sold, mostly to Mexico.

The USDA’s attache in Ottawa projected U.S. corn imports to be 2.3 million tonnes in 2024-25, one million less than the current marketing year due to increased Canadian grain production.

Corn and soy growing areas of the U.S. should see between 13 to 63 mm of rain over the next few days with some areas seeing as much as 150 mm.

China’s ag ministry reported that its sow herd declined 3.6 per cent from last quarter and 7.3 per cent from last year at nearly 40 million head.

SOYBEANS traded at least 10 cent/bu. below the open during trading on Thursday, but eventually recovered to end the day nearly unchanged.

Soybean export sales in the U.S. were below trade expectations at 210,900 tonnes over the past week, while 120,100 tonnes of new crop were also sold.

In total, 307,900 tonnes of old crop U.S. soymeal were sold, as well as 35,100 tonnes of new crop.

Soyoil sales were 16,200 tonnes from old crop and well above trade estimates.

The Council of Palm Oil Producing Countries asked the European Union to postpone the enforcement of deforestation regulations, fearing it would result in supply chain disruptions.