By Glen Hallick, MarketsFarm

Glacier Farm Media MarketsFarm – Intercontinental Exchange canola futures failed to hang on to small gains on Thursday, something an analyst said has been happening recently.

Pressure from most comparable oils was too much for canola to fend off. The Chicago soy complex and Malaysian palm oil moved lower, but there was some support from increases in European rapeseed. Meanwhile choppy trading in global crude oil prices put pressure on the oilseeds.

Prairie temperatures were chilly for mid-April on Thursday, with the eastern half of the region getting precipitation. The western half is forecast to get moisture next week. However, thoughts of dry conditions across the Prairies still lingered in the background.

Read Also

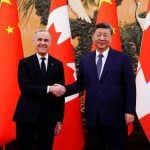

North American Grain/Oilseed Review: Canola up on new trade deal, positives for U.S. grains, oilseeds

Glacier FarmMedia — Canola futures on the Intercontinental Exchange were higher on Friday, hours after Canada and China announced a…

The July contract finished close to its 50-day moving average, but well off of its 20-day and 100-day averages. The latter two converged to be less than 40 cents apart.

Old crop canola crush margins nudged up, with them between C$162 to C$168 per tonne above the futures. The new crop November positions inched up to C$152 to C$157 per tonne.

The Canadian dollar was higher at mid-afternoon Thursday as the loonie rose to 72.62 U.S. cents compared to Wednesday’s close of 72.50.

There were 64,637 contracts traded on Thursday, compared to Wednesday when 70,115 contracts changed hands. Spreading accounted for 50,284 contracts traded.

Prices are in Canadian dollars per metric tonne:

Price Change Canola May 608.70 dn 2.90 Jul 622.30 dn 1.50 Nov 636.60 dn 1.60 Jan 645.20 dn 1.30

SOYBEAN futures at the Chicago Board of Trade were weaker on Thursday in a general downturn in most oilseeds.

The United States Department of Agriculture released its export sales report and for the week ended Apr. 11, soybean sales came to 485,800 tonnes of old crop and 263,200 tonnes of new crop. The old and new crop sales were well within market predictions. As were soymeal export sales of 129,800 tonnes of old crop and 1,000 tonnes of new crop, plus soyoil sales of 100 tonnes.

The USDA announced a private sale for 138,000 tonnes of old crop soymeal to the Philippines.

The Biden administration suggested it could boost tariffs on Chinese steel from the current 7.5 per cent to as high as 25 per cent. That has raised concerns of a trade war that could hurt U.S. ag exports.

Weakness in the Brazil real has made U.S. ag exports less appealing.

The International Grains Council issued its April supply and demand report, which nudged up global soybean production for 2024/25 to 413.3 million tonnes and the carryout to 75.4 million tonnes.

CORN futures were lower on Thursday, with pressure from soybeans holding off support from wheat.

U.S. corn export sales tallied 501,200 tonnes of old crop and 65,000 tonnes of new crop, as both were within trade expectations.

Rain fell over much of Iowa, which has needed moisture.

With Argentina’s corn crop already cut by 6.5 million tonnes at 50.5 million, the Rosario Grain Exchange warned that more reductions are very likely. A spike in leafhoppers has resulted in an outbreak of spiroplasma disease, putting a dent in Argentina’s corn production. That said, the USDA attaché in Buenos Aires chopped six million tonnes from their projection to now 51 million.

The IGC trimmed world corn production by about 7,000 tonnes at 1.226 billion. Ending stocks were lowered by six million tonnes at 291.4 million.

WHEAT futures were mixed on Thursday, with a small loss in Chicago as Chicago and Minneapolis moved higher.

Export sales of U.S. wheat met trade guesses, including the net sales reduction of 93,600 tonnes in old crop, with net sales of 222,000 tonnes of new crop.

The IGC’s wheat estimates were lowered, with world production reduced by one million tonnes at 797.7 million and the carryout lowered by three million tonnes at 259.0 million.

Total world grain production was cut 10.1 million tonnes at 2.32 billion with the carryover reduced by nine million tonnes at 592.8 million.

Japan bought 34,272 tonnes of white and red U.S. wheat. South Korea acquired 50,000 tonnes of U.S. milling wheat.