Chicago | Reuters — Chicago Mercantile Exchange lean hog futures fell on Thursday amid concerns that a reduced pace of slaughtering is limiting demand for pigs that are growing heavier, analysts said.

Slow slaughtering has weighed on hog and cattle futures because livestock back up on farms when they cannot be processed, traders said. Slaughtering has eased as rising COVID-19 cases, particularly of the Omicron variant, have led to staffing shortages, they said.

Meat processors slaughtered an estimated 456,000 pigs on Thursday, down two per cent from a week ago and six per cent from last year, the U.S. Department of Agriculture said. Slaughtering on Wednesday fell to its lowest level since August.

Read Also

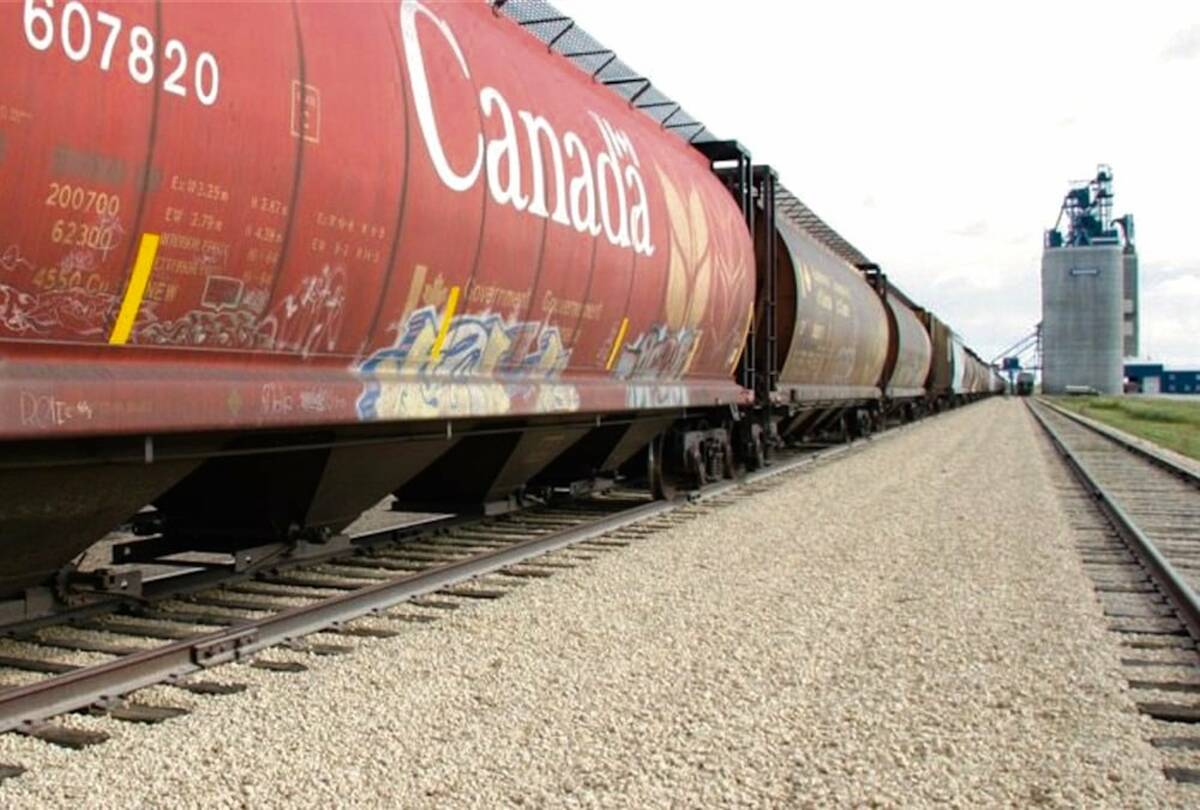

Canadian National Railway files with U.S. regulator for more details on Union Pacific-Norfolk deal

Canadian National on Monday said it filed a motion with the U.S. Surface Transportation Board that asks the agency to order Union Pacific and Norfolk Southern to disclose more details on their proposed merger.

Some meat processors slow slaughtering to increase profit margins by limiting supplies, said Brian Hoops, president of U.S. broker Midwest Market Solutions.

“It would be much more positive to work through some of these hogs,” Hoops said.

The average weight for hogs in Iowa, southern Minnesota and South Dakota in the week ended Jan. 8 was 292.2 lbs., up from 291.4 in the previous week, USDA said.

“It’s bearish because we have more product that way,” Hoops said.

CME February lean hogs ended down one cent at 77.85 cents/lb., giving back gains from Wednesday.

Still, USDA reported mostly higher U.S. wholesale pork cutout values, with the carcass value up by $10.82 per hundredweight (cwt).

Pork processors earned about $19.95 per hog slaughtered on Thursday, up from $13.40 on Wednesday, said HedgersEdge.com. A week ago, margins were $20.30 per hog.

Beef processors’ margins rose to $344.40 per head of cattle on Thursday from $323.95 on Wednesday and $225.35 per head a week ago, HedgersEdge.com said.

Boxed beef prices were higher for choice and select cuts, USDA said.

CME February live cattle futures settled up 0.425 cent at 137 cents/lb. March feeder cattle futures ended 1.7 cents higher at 166.725 cents/lb., as prices tumbled for grains and soybeans used in feed.

— Tom Polansek reports on agriculture and ag commodities for Reuters from Chicago.