Despite voting against a bill to exempt certain farm fuels from the carbon tax, the governing federal Liberals say tax relief for grain drying is coming.

Conservative MP Philip Lawrence’s private member’s bill C-206, An Act to amend the Greenhouse Gas Pollution Pricing Act (qualifying farming fuel), passed second reading in the House of Commons on Wednesday, and was forwarded to committee for review.

The bill got to that point without support from the governing Liberals save for one member, southeastern Ontario MP Francis Drouin.

Read Also

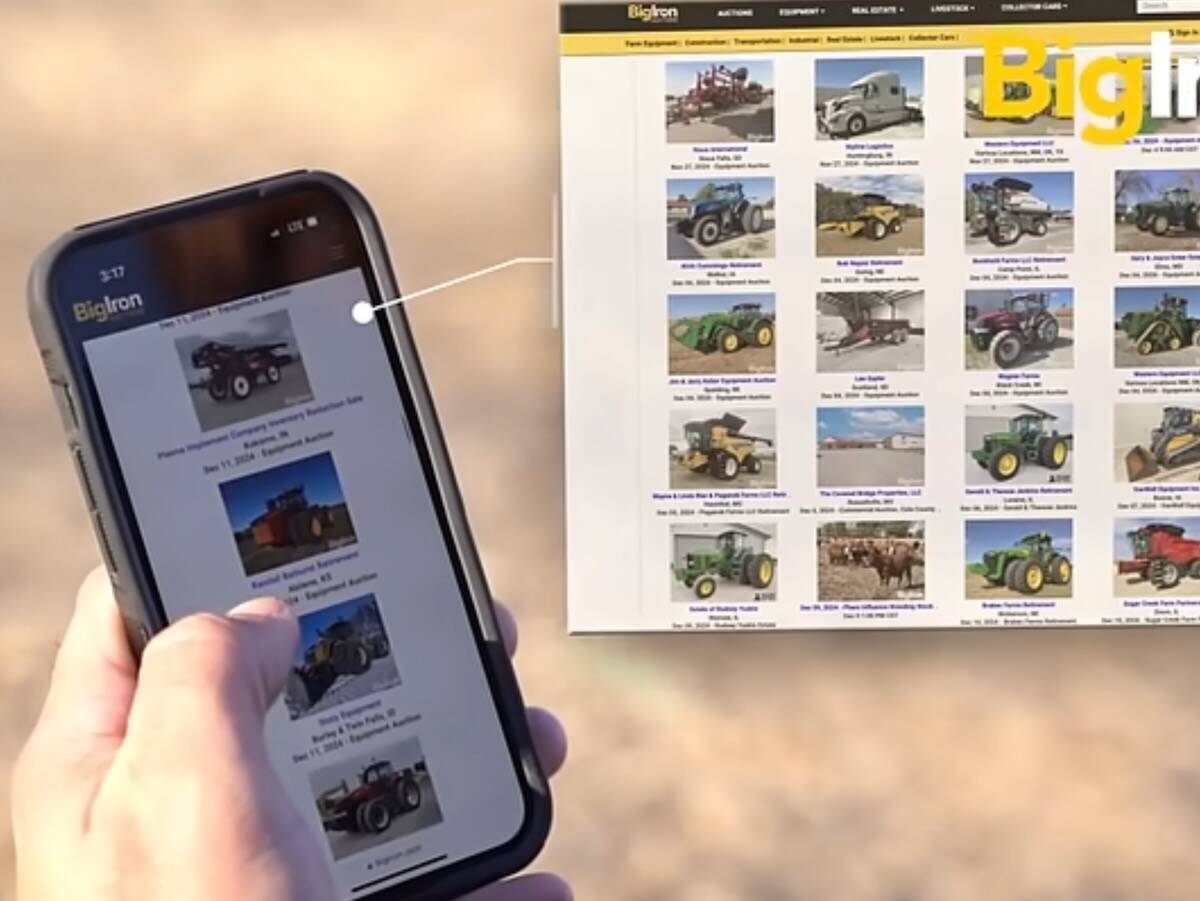

Ritchie Bros. parent to buy online auction firm BigIron

RB Global, the parent of Canadian auction firm Ritchie Bros., is further expanding its reach into the online farm auction market with a deal for Nebraska-based BigIron Auction Co.

Introduced by Peterborough-area Conservative MP Philip Lawrence in February last year and reinstated in the current session, the bill got support from each of the opposition parties, with the Bloc Quebecois, Green Party and New Democrats joining the Conservatives in voting for the bill to move to committee.

Before the vote on C-206 was held, Agriculture Minister Marie-Claude Bibeau and Environment Minister Jonathan Wilkinson released a joint statement signalling their intentions.

C-206, they said, “does not provide relief for the fuel costs of grain drying, as it does not add grain drying as an eligible farming activity.”

Contention over the bill’s text was part of the debate MPs held in the House before voting on it, and Lawrence was firm in his assertion his bill would exempt fuels used for grain drying.

Western Manitoba MP Larry Maguire, who seconded Lawrence’s bill, said in a statement Thursday it would “provide a full exemption on all farm fuels, including natural gas and propane.”

Rather than pass a bill introduced by an opposition member, the Liberals are signalling intent to introduce their own bill offering relief to farmers drying grain.

“We are committed to new rebates for on-farm fuel use such as grain drying, in order to both support our food producers and also encourage new investments in sustainable technologies, that go beyond existing exemptions for farm fuels and rebates for greenhouses,” the ministers said in their statement.

“In addition, our government will make grain drying and barn heating a priority focus under the new $165 million agriculture clean technology fund. The program will invest in energy efficiency, fuel switching, and other new technologies on farms. This program will be announced in the coming months.”

No further details, or specific timelines, were offered.

Facing scrutiny for the grain drying costs farmers bore during a particularly wet harvest last year, Bibeau avoided making any commitments but defaulted to a favoured position: requesting more information on the matter.

While the Liberals deliberate their own plan to relieve farmers of grain drying costs, continued industry support for C-206 is clear.

The momentum of Lawrence’s bill, coupled with the Liberals’ new, albeit vague, commitment should ensure farmers will be getting some form of relief from grain drying – but when is still unclear.

C-206 getting to committee marks the halfway point in a six-stage process toward a bill becoming law, but like many private members’ bills, it faces a long road to possible passage.

If Parliament doesn’t prorogue first, the Commons standing committee on agriculture and agri-food will hear testimony from stakeholders in and outside of government before reporting back findings and possible amendments to the House of Commons.

The bill would die on the floor and would have to be introduced for a third time if government rises and the current parliamentary session ends before its passage — a looming threat in any minority government situation. This scenario would essentially mean the bill goes back to its infancy, and the process of its passage would begin again.

Last year, federal officials told a committee of MPs that an Agriculture and Agri-Food Canada (AAFC) internal analysis suggests costs of grain drying are “a fairly small share of overall costs.”

While the analysis has not been made available to the public, officials say grain drying costs typically represent only one to two per cent of total costs for producers.

Provinces and provincial producer groups have put forward numbers suggesting carbon taxes — including those on fuels used grain drying — account for a significantly higher amount of overall costs, but AAFC officials suggest those figures factored in indirect costs, resulting in a higher estimate.

An evaluation of grain drying costs provided by some provincial governments or producer groups was done in 2019 by AAFC. The results don’t represent AAFC’s estimates and instead represent a standard set of results from different groups to offer comparable results.

“Based on the information received, the average per-farm cost of pollution pricing associated with grain drying by province ranges from 0.05 per cent to 0.38 per cent of net operating costs for an average farm, equivalent to $210 to $774, depending on the province in question,” that report said.

— D.C. Fraser reports for Glacier FarmMedia from Ottawa.